When the economy fully reopens, as is looking more likely midway through this year, one of the most targeted destinations, at least in my view, will be outdoor shopping malls, for a couple reasons, asserts Bryan Perry, growth and income expert and editor of Cash Machine.

The job market will have improved, providing people with more discretionary income, people still cautious of Covid will default to outdoor shopping experiences versus indoor and everyone just wants to see a vibrant setting with a sense of normality where people watching takes on a whole new meaning.

The “let’s go to the outdoor mall” experience belongs to the largest player in the space — Tanger Factory Outlet Centers Inc. (SKT).

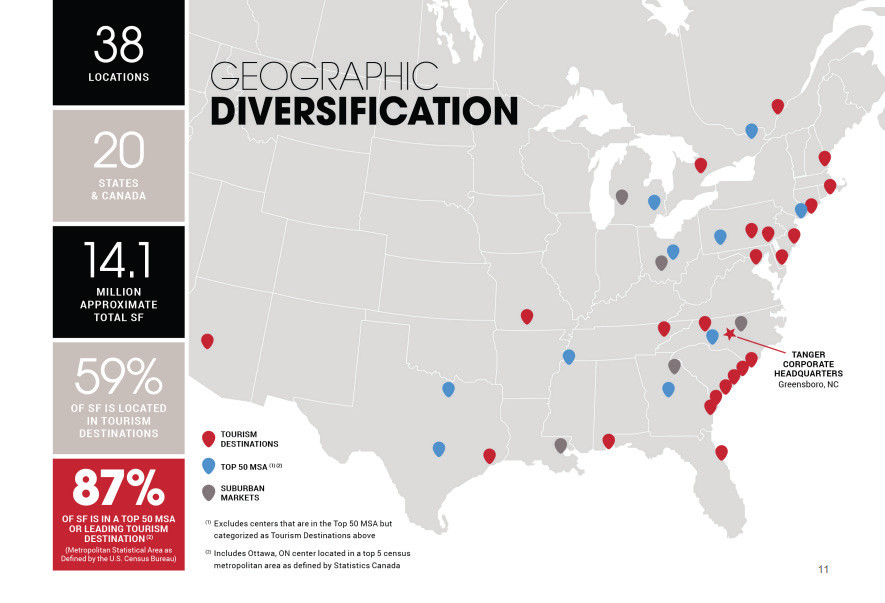

This real estate investment trust is a leading operator of open-air upscale outlet shopping centers. It owns, or has an ownership interest in, a portfolio of 38 such centers. Plus, 59% of Tanger’s malls are in targeted tourist destinations. If there were ever a time to buy into America traveling and shopping again… this is it.

Tanger’s operating properties are located in 20 states, mostly in the southeast United States and in Canada, totaling approximately 14.1 million square feet, leased to over 2,700 stores operated by more than 500 different brand name companies. The company has more than 39 years of experience in the outlet industry.

For millions of Americans, there will be fewer experiences that satisfy more than a day of browsing and shopping at the local outlet mall, shopping or even having the opportunity to pull down an annoying mask while you have lunch or dinner.

I personally can’t wait for that moment. We’ve been living like work-from-home zombies for a year, and soon the chains of restriction will be loosed and we’ll meet up with friends and family at a fresh air mall as one of many get back-to-normal destinations.

So why Tanger? Easy… the company is a run by superior management that reinstated its dividend recently. Revenues are forecast to rebound by 12% to $410 million and the company is to return to profitability this year. The company has radically streamlined operations and pays a current dividend yield of 5.4%.

But here’s the juice for why I’m really excited about Tanger. There are 47 million shares short of 89 million in the float. That means that 75% of the stock is short, a huge bet that this company will continue to lose value. If this stock gets moving north, as I suspect it will in the weeks and months ahead, this could be one of the next great short-squeeze trades in 2021.

Tanger reported Q4 core FFO per share of $0.54 cents. This exceeded the consensus estimate of $0.37. Q4 total revenue of $111.2 million beat the $103.9 million consensus. This figure compares nicely with $103.2 million in Q3 and $116.6 million in Q4 2019.

Rent collections for Q4 improved to 95% of billed rents at the end of January. SKT expects 2021 core FFOs per share of $1.47-$1.57, higher than the $1.44 average analyst estimate. For Q4, traffic improved to ~90% of prior-year levels and increased to more than 99% in January for its domestic centers.

While I fully get that the e-commerce wave will continue to dominate much of our shopping pattern, the outdoor mall experience in states where migration is booming in the southeast should thrive.

Outdoor malls in good weather are simply a go-to situation for millions of us. And now is the time to buy this experience at a big discount.

The investment proposition is that Americans get back to being with one another and cracking the trend of convenient isolation that has captivated society for the past several years. It is not good for our communities and its not good for our personal well-being.

If there is anything good that comes out of the pandemic, it’s a reminder that we function better when we interact. I believe that visitng a Tanger Outlet Mall will be huge in 2021. We are raising our buy limit to $16.