The trouble with bubbles is that they're always invisible to those inside the bubble, cautions Jim Stack, a leading value-oriented money manager, market historian and editor of InvesTech Research.

Although the debate will continue to rage in the media whether there are simply pockets of excess froth and speculation, or whether Wall Street’s extraordinary valuations have become a dangerous bubble, one fact is certain: If it is a bubble that ends badly, the Federal Reserve will own it “lock, stock, and barrel.”

Risk-conscious investors today are facing a problem: how to invest through a speculative mania. It isn’t the first such period in history and it won’t be the last.

Unique to today’s situation, however, is the fact that the market has the full support of the Federal Reserve behind it, and as a result, investors seeking yield and a reasonable risk/return proposition are facing quite a conundrum.

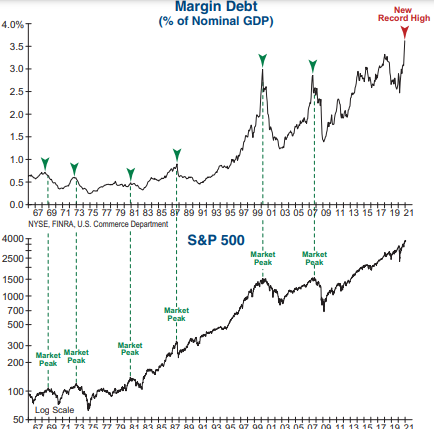

The mania on Wall Street has also become apparent in margin debt, which surged to an all-time high in its most recent reading (see chart below).

Since margin debt is money borrowed by investors to buy more stock, it is a good measure of speculation and elevated market risk. Incredibly, this latest significant increase in margin debt does not yet include any of the Reddit-driven frenzies in highly shorted stocks that occurred in January and February.

Parabolic moves in margin debt — like what we are seeing today — were precursors to the market peaks in both 2000 and 2007. The extreme degree of market vulnerability represented by this indicator will not be revealed until a final peak is reached and this leverage starts to rapidly unwind.

This stock market currently offers an unusual combination of opportunity and risk, and a number of those risks are historically extreme. There is ongoing technical support for giving this bull market the benefit of doubt.

Additionally, there is light at the end of the tunnel with the rapid vaccine rollout and significant decline in new cases of COVID-19 in the U.S., which will likely release pent-up consumer demand — especially as it relates to travel.

In the meantime, there remains a great deal of uncertainty today as lockdowns continue, and both consumer and business confidence flounder. From an investment standpoint, the downside to this recovery is that it already has the hallmarks of a mature bull market.

Valuations are extremely high, even when including the most optimistic earnings projections. Furthermore, speculative excesses have reached a dangerous level, as individual investors clamor for ‘get rich quick’ ideas.

Massive government stimulus efforts and unprecedented monetary easing are supporting this recovery, with seemingly no end in sight. Along with that comes the risk of rising inflation, which ultimately may force the Fed’s hand to tighten monetary policy. These subtle forces are already beginning to show at the earliest stage of the manufacturing 0 cycle (see chart below).

Until that point arrives, we continue to explore opportunities with acceptable risk and return characteristics —both domestically and internationally — while maintaining the framework of our “safety-first” investment strategy.

Despite the fear of missing out (FOMO), investors should avoid the intoxicating herd mentality, and maintain a healthy cash buffer given these extreme market conditions.