After a year mired in COVID misery, the economy is returning to normal. Stock prices and commodities are flying — and inflation expectations are rising, observes Genia Turanova, editor of Curzio Research's Unlimited Income.

Despite what the Fed wants us to believe, inflation is coming. Moderate inflation — under 2% or so — isn’t such a big deal, at least from a policy point of view.

In fact, slight price increases are much more desirable than declining prices. When tomorrow’s dollar is worth less than today’s, people and businesses don’t want to be in cash. They have no choice but to invest if they want to preserve the value of their assets.

Moderate inflation is, therefore, slightly stimulatory. This is why the Fed wanted to bring the rate of inflation up from zero… while making sure it’s not out of control.

Another reason: The rate of inflation should, more or less, agree with the overall level of interest rates. We can tolerate zero rates on our saving accounts when inflation is running low.

But the higher inflation gets, the higher is the interest rate we would demand to compensate for the decline in the real value of our savings over time.

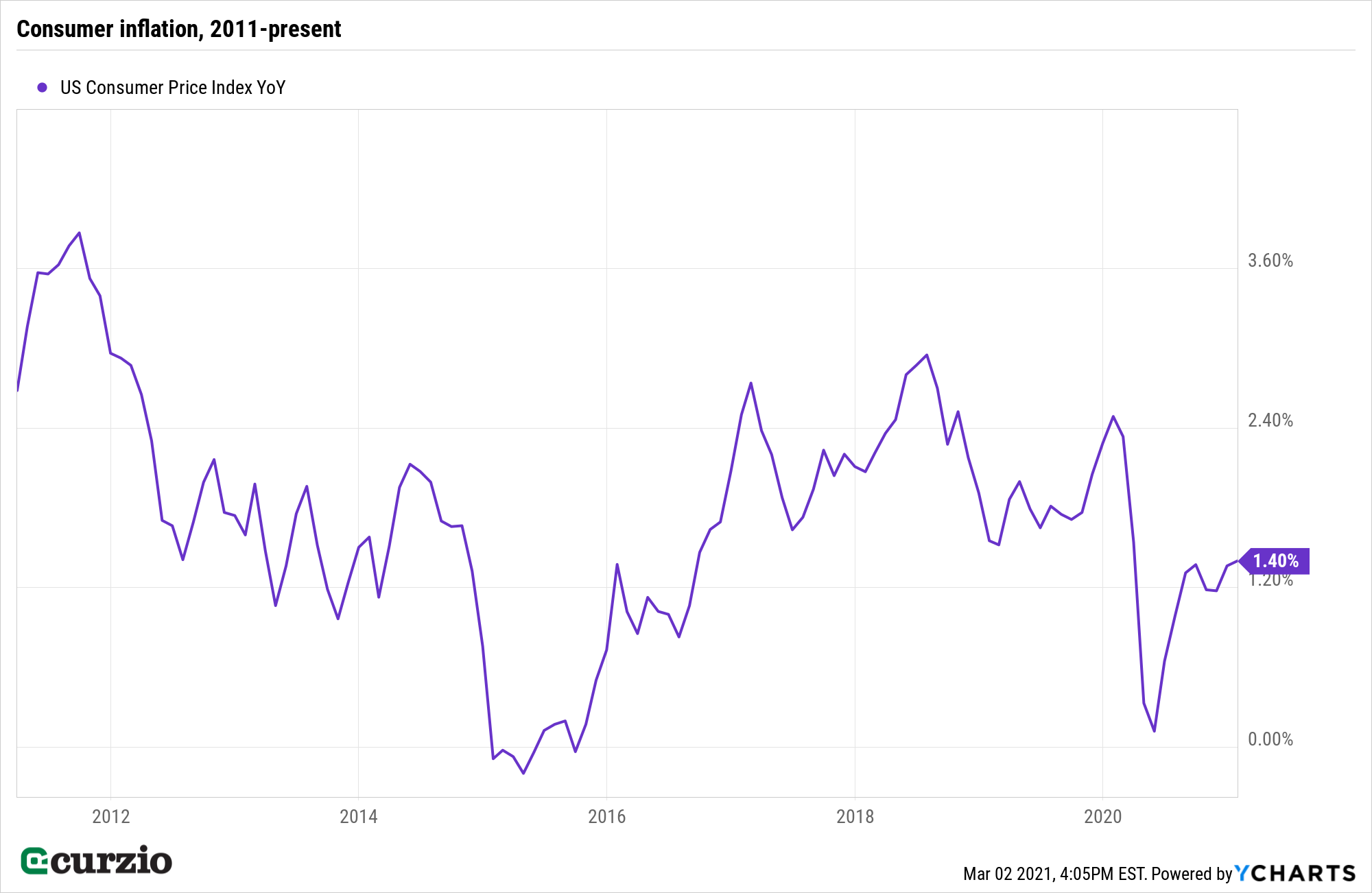

And even with moderate inflation, that loss can be substantial. For example, over the past decade, consumer inflation (measured by the Consumer Price Index [CPI]), has rarely hit the Fed’s target of 2%.

But even a decade of 2% (or lower) inflation was enough for the U.S. dollar to visibly lose a lot of its purchasing power: $100 in 2011 had the same purchasing power as $118.78 today. In other words, you’d have to earn 18.8% on your assets (net of tax) simply to stay even with inflation.

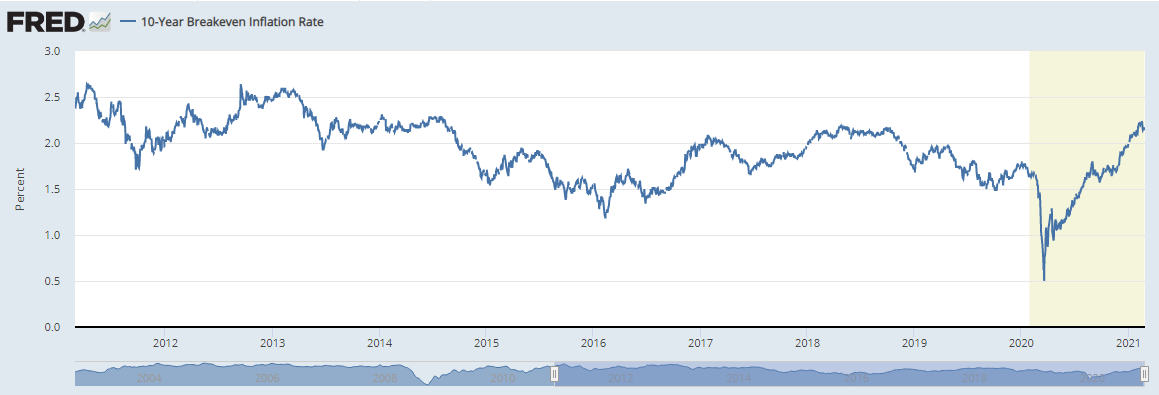

One measure of inflation expectations, based on a 10-year breakeven rate, was recently as high as 2.22% — a level last observed in 2014.

Commodities are soaring, too. Meanwhile, the Fed has committed to keeping interest rates steady for longer. Translation: Central bankers are willing to get the economy going at the expense of inflation.

Thanks to that, plus the enormous stimulus bill now making its way through Congress, the economy could overheat — and the Fed won’t do much. Inflation can get out of control fast. In that case, investors will benefit from an inflation hedge.

One such hedge is a special class of U.S. Treasury bonds, designed to deliver interest income that keeps up with the level of inflation. These are called Treasury inflation protected securities — or TIPS.

The principal of a TIPS bond increases with inflation and decreases with deflation (as measured by the CPI). At maturity, a TIPS bond will pay the greater of either the adjusted principal or the original principal.

TIPS pay interest twice a year at a fixed rate. But because the rate is applied to the adjusted principal, interest payments will also rise with inflation and fall with deflation. Thus, when you’re worried about inflation, they’re a better alternative to holding cash.

First created in 1997, when inflationary concerns reemerged, TIPS are now offered in 5-, 10-, and 30-year maturities.

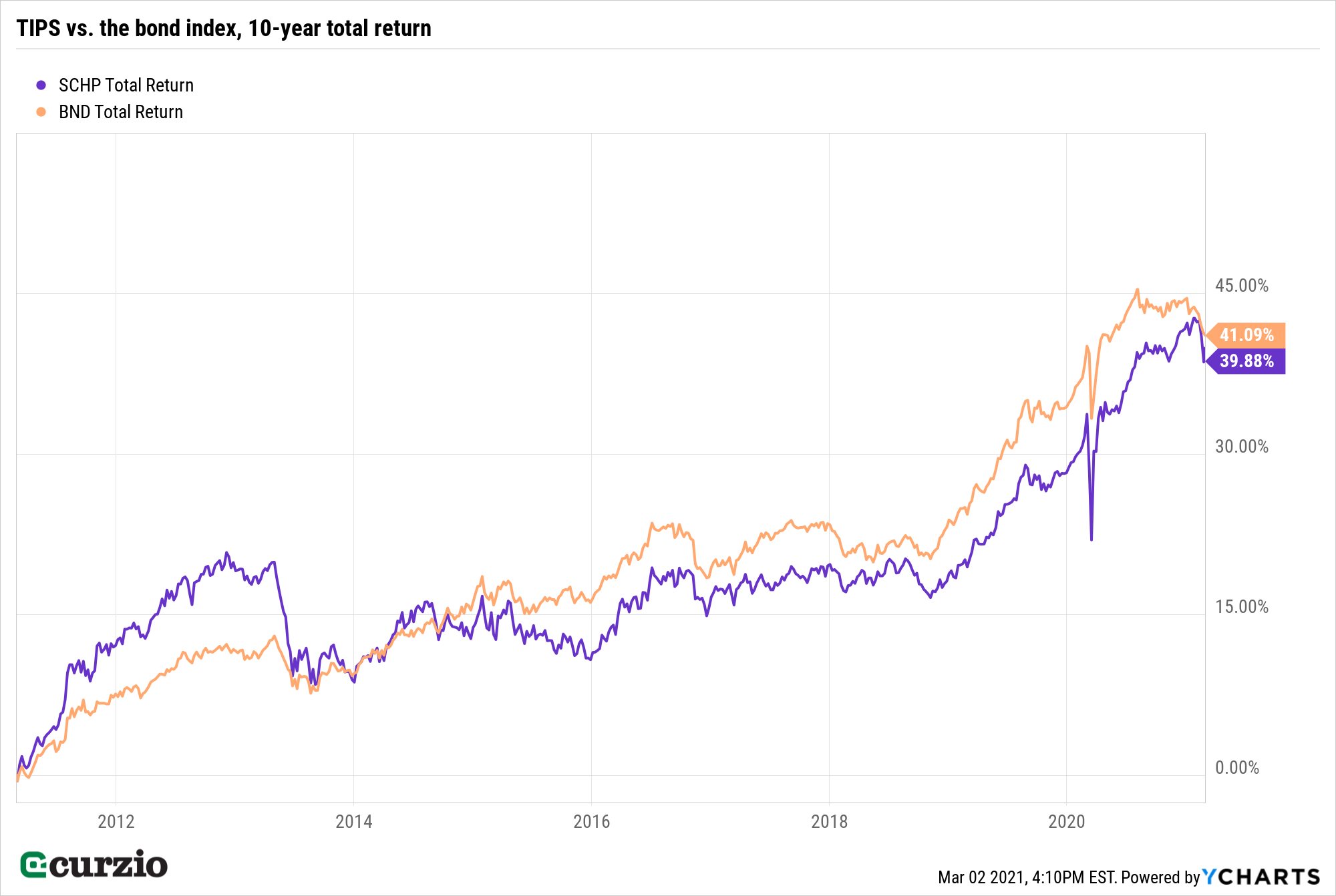

Over the past decade, TIPS delivered a 4% average return (price appreciation plus dividend)—beating inflation if not the overall market.

And while TIPS has underperformed the Vanguard Total Bond ETF Index (BND) since 2014. TIPS did much better than the average bond in 2012–2013, when inflation was running above the Fed target.

I expect this outperformance to repeat from this point on.

There are downsides to TIPS, too. First, the yields are tied to the yields of regular Treasuries and therefore currently quite low. Second, because of the way TIPS address inflation—adjusting the principal semi-annually based on the CPI—these bonds can only compensate for inflation as the CPI reflects it. And finally, because they are bonds, TIPS are poised to decline when interest rates move higher (all else equal).

Still, TIPS are one of a few fixed-income investments that offer some inflation protection. And it’s quite easy to invest in TIPS via exchange-traded funds (ETFs).

My favorite ETF in this category is Schwab U.S. TIPS ETF (SCHP), which holds more than 40 different bonds with a total value of more than $15.5 billion.

This fund is liquid and among the cheapest compared to similar funds — it only costs 0.05% (the “expense ratio”) a year to own. In other words, you’ll pay 0.05% of the dollar value invested in the fund annually to service it (holding and, as needed, buying and selling of the individual bonds).

SCHP is a much better bargain than the large competing fund, iShares TIPS ETF (TIP), which has a substantially identical portfolio but a much higher expense ratio at 0.19%. Because the yield on TIPS is related to the yield on Treasuries, SCHP also generates a decent enough yield of about 1.1% — a yield set to rise if the CPI moves higher.

Holding 43 TIPS securities with various maturities, SCHP is a great hedge against the damage inflation can wreak on the purchasing power of your assets.

Action to take: Buy a 1/2 position in Schwab US TIPS ETF for portfolio security and inflation protection. Don’t pay more than $62.50 per share.