What if we told you there are two companies that have provided reliable income that has been uninterrupted since their IPO over 20 years ago? asks income expert Rida Morwa, editor of High Dividend Opportunities.

That these companies have increased their dividends every quarter for over 20 years? Completely unfazed by the tech bubble burst, the Great Financial Crisis, and the impact of COVID-19, these companies raised their dividends even as other companies were cutting.

Realty Income (O) currently yields 4.5%, and has actually trademarked "The Monthly Dividend Company." O has achieved Dividend Aristocrat status by raising their dividend every year for over 25 years.

For the past 23 years, O has raised its dividend every quarter. Getting paid monthly, quarterly dividend raises, and outperforming the major indexes — there's a lot to love about O.

W. P. Carey (WPC) has a higher yield at 6.0%. WPC's dividend payments are quarterly, and it has raised its dividend every quarter for the past 20 years. Let's take a look at how these two premium REITs have managed to provide shareholders with consistent raises every quarter for decades.

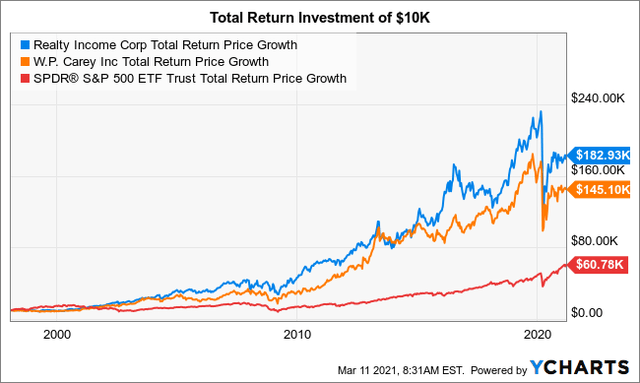

This pair provides a great income today. They have demonstrated incredible durability through several periods of economic turbulence, and their dividend raises are as reliable as the sun rising in the morning. And by the way — both have run circles around the S&P 500 in total return:

Triple-Net

Let's look at their secret.

When it comes to investing in real estate, the "triple-net" lease structure has become one of the favorites for investors. This leasing structure makes the tenant responsible for most property-level costs, allowing the landlord to take a very hands-off approach and not have to worry about the variability of expenses.

Expenses like utilities, property tax bills, snow removal in the parking lot, and insurance can be variable and go up more often than not. The triple-net structure puts all of that risk on the tenant. This makes triple-net leases ideal for landlords who want to be investors, not property managers.

From an underwriting perspective, these REITs really look at the leases as a credit transaction. They underwrite the credit quality of the tenant every bit as much as they consider the value of the underlying property.

Triple-net leases can be applied to virtually any property type as long as it's leased to a single-tenant. This means that O and WPC have been able to be incredibly diversified by tenant. Additionally, since the landlord does not need to have any boots on the ground to maintain the property since maintenance is the tenant's responsibility, they can be very diversified geographically.

Among O's top industries, they are invested in convenience stores, grocery stores, drug stores, and dollar stores. All industries that are very defensive in any economic conditions. In times of COVID-19, these were the stores that never closed as they were deemed "essential."

WPC takes on a very different segment, industrial and warehouse properties being their largest allocations and retail making up only 18%.

As a result, investors can own both REITs without fear of substantial overlap. Both have substantial diversification on their own. We have the advantage of being even more diversified by owning both companies.

Conclusion

There are a lot of great REITs to invest in, yet O and WPC stand in a class of their own.

Both companies have an exceptional dividend history and are the only REITs that have raised their dividends every quarter for more than 20 years. That's an incredibly impressive achievement, especially considering the periods of turbulence we have seen since 1998.

These investments are great for current income, and they are fantastic for dividend growth investors. With the current market and economic conditions, we expect that dividend growth will be above average in 2021 and well above average in 2022.

The best part is that neither is stopping now. Both REITs took advantage of the decline in rates to refinance debt and to take out bonds at incredibly low rates. They are aggressively buying properties, using the same tried and true underwriting that has rewarded shareholders for decades.

They are excellent buys for investment even if they were fully valued. Yet today, they are trading at a deep discount with regard to both their absolute and relative valuations. Growth will kick in even faster with the economic recovery.

Investors can expect price upside of over 30% even before receiving the quarterly dividend growth that we know is coming. As income investors and preparing for retirement, we love receiving those recurring dividends, and the bigger they get, the better.

If you are worried about having missed the big rally, don't be! O and WPC are two of our favorite REITs to buy today, and they are cheap. They carry a solid dividend today, time-tested and proven stability, quarterly income growth and +30% price upside in the near term. These could be your biggest winners in your retirement portfolio.