The VanEck Vectors Semiconductor ETF (SMH) is an open-ended fund that tracks a market-cap-weighted index of 25 of the largest U.S.-listed semiconductor companies, suggests Jim Woods, growth stock expert and editor of The Deep Woods.

This exchange-traded fund is highly concentrated in common stocks and depositary receipts of U.S.-listed semiconductor companies. Mid-cap companies and foreign companies listed in the United States can also be included.

To be initially eligible, 50% of company revenues must be primarily in the production of semiconductors and semiconductor equipment.

The top 50 eligible companies by market cap are then given two separate ranks based on free-float market capitalization in descending order and three-month average daily trading volume in descending order.

Then, those two ranks are summed, and the top 25 companies are selected. A capping scheme is applied to ensure diversification and more weight is given to the larger companies.

The Index seeks to track the most liquid companies in the industry based on market capitalization and trading volume. Index methodology favors the largest companies in the industry, leaving SMH with over 98% of its holdings in large-cap companies.

Its portfolio may include both domestic and U.S.-listed foreign companies to provide enhanced industry representation.

Its inception was in May 2000. With an expense ratio of 0.35%, the fund is relatively inexpensive to hold compared to other ETFs, and it has an average spread of 0.01%.

SMH seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the MVIS US Listed Semiconductor 25 Index, which is intended to track the overall performance of companies involved in semiconductor production and equipment.

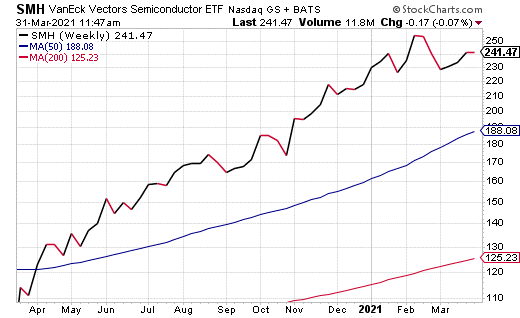

Plus, semiconductor stocks generally have pulled back in recent weeks, so those looking to gain exposure to the sector can do so now for a nice discount compared to just a month ago.