A revival of interest in home gardening, along with rapid expansion in the commercial cannabis market, have resulted in a major growth spurt for Scotts Miracle-Gro (SMG), explains Mike Cintolo, growth stock expert and editor of Cabot Top Ten Trader.

As more U.S. states legalize both medical and recreational cannabis, growers are allocating more crop to the indoor production techniques that Scotts services.

Through its Hawthorne subsidiary, Scotts provides nutrients, LED lighting, automated growing systems and related equipment for hydroponic (soil-less) production of marijuana and other high-value crops.

In fiscal Q1, Scotts posted record revenue of $749 million, which increased 105% — thanks largely to improving inventory levels and consumer market sales. (The company also indicated that shipments remained strong through the first month of Q2.)

The cannabis side of the business, meanwhile, contributed to Scotts posting its strongest earnings in Q4 2020 and Q1 2021 and recording its first-ever first quarter profit (usually a seasonally slow quarter).

Elsewhere in the lawn and garden segment, Scotts closed a deal in Q4 for a 50% stake in edible gardening supplier Bonnie Plants, while in November Scotts completed the acquisition of AeroGrow International, a maker of hydroponic gardening equipment for the home market. (Sales of AeroGrow’s tabletop herb-growing kits more than tripled to over $31 million in the first six months of 2020!)

Going forward, the company is putting more of its chips in cannabis, as evidenced by its recent opening of the world's first R&D facility in Canada dedicated exclusively to marijuana production.

Management also raised guidance for its Hawthorne unit, with the full-year sales expected to be up around 25% (prior forecasts was 18%) based on a “historically strong start” to the year — and even that will likely prove too low. It’s a good story.

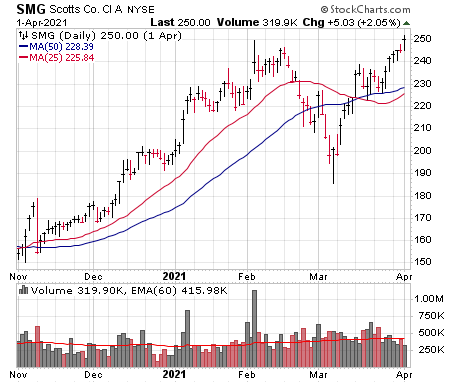

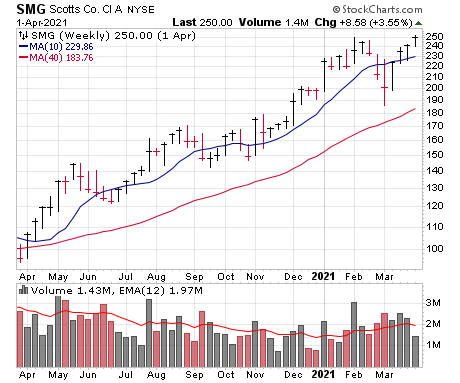

In line with other cannabis-related stocks, SMG experienced a powerful rally starting in November and peaking in February. Shares also followed the industry-wide stock price decline into early March before finding support near the 40-week line.

But unlike many other pot stocks, SMG has shown unusual strength in powering back to its prior high around $250. If you’re game, we suggest aiming for dips of a few points to enter.