There are three things that have been pressuring gold: the dollar, bond yields and sentiment. Naturally, they are all interrelated. And it’s possible, very possible, that they’ve all run out of steam, notes Peter Krauth, editor of Resource Maven's Gold Resource Investor — and a participant in MoneyShow's Metals & Mining Virtual Event on April 20-22. Register for free here.

In the last couple of days, long term yields and the US dollar have backed off. And sentiment may well have reversed. It may be that gold will remain range-bound for a while as it awaits a new catalyst to trigger its next upleg.

Only time will tell. But if it has stopped falling, then that will certainly be a welcome development. Given gold’s had its worst quarter in 4 years and its worst start in almost 40, maybe sentiment has swung enough that the selling has been exhausted.

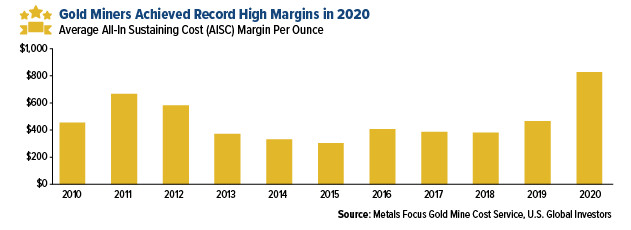

As for physical gold buying, it’s been on fire. And according to U.S. Global Investors, gold producers had their most profitable year ever in 2020. The average profit per ounce mined was $828, which is well above the previous high in 2011 at $666.

If we look at what technical action in the gold price has been, there are some encouraging signs. Though not by much, the March 30th low was slightly higher than the March 8th low. Taken together they appear to have formed a bullish “double-bottom”.

What’s further encouraging is that the RSI’s dip below 30 and reversal higher (around March 8th) may have marked a new upleg. As well, the RSI and MACD momentum indicators have been trending higher, confirming gold’s recent higher low and possible new uptrend.

From a technical price perspective, we need to see gold regain the $1,770 level, which is its 50-day moving average. If we get that and it holds for a few days, we may be off to the races once again.

The first target from here will be $1,750 which has acted as overhead resistance in the past. If gold closes and stays above, that could become a new support level instead.

Meanwhile, I believe most of the stocks in our gold portfolio are looking oversold right now. Here's a look at a few of our portfolio holdings:

Calibre Mining (Toronto: CXB) (OTC: CXBMF) announced a positive Pre-Feasibility Study (PFS) for its Pavon gold mine in Nicaragua. Pavon Norte is a producing open pit whose ore it being trucked to the Libertad mill.

According to the PFS, the Pavon open pit gold mine will have 4 year mine life, produce 47,000 gold ounces annually at average $711 all-in sustaining costs (net silver credits), with an after-tax (5%) NPV of $106.4M at $1,700 gold.

The Libertad mill continues to have significant surplus capacity, and additional resources outside the reserve mine plan have potential to extend mine life. Management continues to advance the low cost “Hub-and-Spoke” model.

Updated mineral reserves and resources at El Limon and La Libertad complexes in Nicaragua generated 202% increase in reserves, the largest in 10 years at the highest grade ever. The shares are exceedingly cheap, and due for a re-rating.

Equinox Gold (EQX) announced a positive Feasibility Study (FS) on its Castle Mountain (California) Phase 2 expansion, which demonstrates an additional 3.2M gold ounces at an average all in sustaining cost (AISC) of $858/oz.

Even at $1,500 gold, it has an after-tax net present value (NPV) at 5% discount of $640M, and an internal rate of return (IRR) of 18%. This will generate nearly $2B of net cash flow at current gold prices.

Further engineering will be needed in parallel with permitting. However, this will ultimately provide a good boost to overall gold production. The IRR at 18% is low, but rises to 25% at $1,800 gold.

Equinox announced the sale of some of its shares and warrants of Solaris to Augusta Investments, a strategic shareholder. Proceeds were C$82.5M, and could reach C$132.5M if all warrants are exercised. Equinox is very cheap on a forward P/E basis.

SSR Mining (SSRM) reported year-end 2020 reserves and resources. Gold mineral reserves +5% to 8M ozs. (9M AuEq). Measured and Indicated gold resources +14% to 15M ozs. (27M AuEq).

This year SSR Mining should generate about $300 more of free cash flow per ounce of gold produced vs. its peers group.

Debt is $440M while consolidated cash is a robust $897M. The stock currently yields a healthy 1.3%, and is also very cheap on a forward P/E basis.