UnitedHealth Group (UNH) is a great stock that is rarely fairly priced. But it sits in the blue-chip bargain bin, at least for now, thanks to a growth driver that is hidden in plain sight, suggests Brett Owens, editor of Contrarian Outlook's Hidden Yields.

The largest health carrier in the US is one of the most consistent profit-growers out there. It’s boosted EPS (earnings per share) at a 10% annualized rate over the last decade, enjoying its lucrative business niche of health care insurance.

Now, its perennial growth isn’t simply due to good fortune. The firm had the foresight in 2011 to start its own technology driven Optum unit. Optum provides pharmacy benefits, runs clinics and supplies data analytics and other cutting-edge tech to streamline healthcare.

We’ve already enjoyed 25% returns in just 15 months from UnitedHealth Group, but we shouldn’t let yesterday’s stock price cloud our judgement about tomorrow.

When we bought UNH in January 2020, Optum had grown so much that it accounted for nearly half of the company’s overall profits. We reasoned that with Optum growing faster than the firm’s legacy business, it was a sweet inflection point for us to purchase shares.

Likewise, health care organizations are adopting the Optum platform to help sort through their huge mounds of data to make better decisions. For example, there are reams of clinical patient data that could help establish industry best practices around treatments and techniques.

Problem is, until recently, much of it has still been on paper! As this information becomes digitized, Optum is able to model the data and provide answers to questions that health care providers may or may not have thought to ask, such as:

• Which pediatric asthma patients are most likely to visit the ER?

• Which heart failure patients are at highest risk of hospitalization in the next 6 months? (Source: Optum.com)

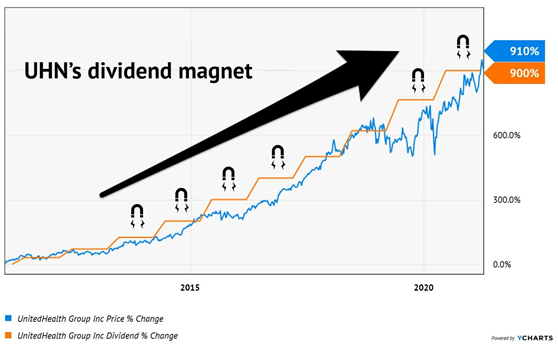

Granted, we don’t need Optum or a supercomputer to model UNH’s share price. The stock simply follows its dividend higher over time. Since January 2011, the stock is up 910% thanks to its dividend, which gained 900% over the same time period:

No Optum Needed to Model This Payout-Price Path

(Please note, the total return for UNH—which includes dividends paid—clocked in even higher at 1,080%.)

Any stock that climbs with this payout is one we want to own. UNH has doubled its dividend over the past five years, and management will likely raise its payout again this June. Let’s make sure we “front run” this dividend hike by buying shares now, as I bump our buy price up to $390 per share.