Technical expert Dan Sullivan — editor of The Chartist newsletter — maintains a trading portfolio of stocks showing high relative strength. Here's a look at two of his recent portfolio ideas, one in the tech sector and one in the gambling world.

Applied Materials (AMAT) is a leader in materials engineering solutions which are used to produce virtually every new chip and advanced display in the world. Earnings per share were up 41.84% year over year to $1.39, which beat the estimate of $1.28.

For the first quarter ended Jan. 31, 2021 revenue rose 24% to $5.16 billion and ahead of estimates of $4.97 billion. Earnings rose 41.8% to $1.39, which beat the estimate of $1.28.

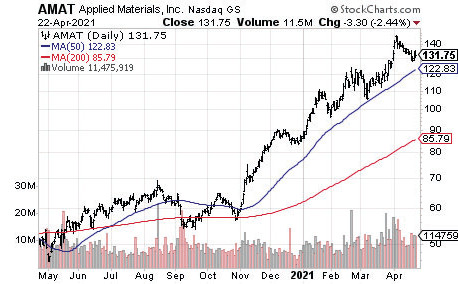

The shares have come under selling pressure since hitting its high on April 5 at $146. This action has repeated over the past several months as the price has dipped to its 50-day line on three separate occasions before proceeding to new highs. The result has been a textbook bullish staircase pattern with a series of higher highs.

If the market remains healthy, we view this as another consolidation phase that could lead to new highs. Its relative strength remains strong and it’s trading above both its 50 and 200-day lines.

MGM Resorts International (MGM) is a holding company that owns and operates casino resorts. It operates in two segments: domestic resorts and MGM China. Its portfolio includes 29 properties in the U.S. and Macau, including Bellagio, MGM Grand, Aria and Park MGM.

The company is expected to make most of its profits in the coming years from the exploding online sports betting platforms. The company said it expects its BetMGM will have $1 billion net revenue by 2022, up sharply from $178 million in 2020.

With most of its Las Vegas casinos closed due to the pandemic revenue should receive a sharp boost on the reopening of the economy.

The stock has come under modest selling pressure since recommending it for traders on April 8. It briefly dipped below its 50-day line on April 20 but has rallied since then.

It will be highly positive if it can break above resistance at the $43 level. It remains comfortably above its 200-day line and maintains a strong relative strength ranking.