We’re now seeing quite a few signs that the bull market in stocks is likely in its final stages and approaching a major top, cautions Mary Anne and Pamela Aden, editors of The Aden Forecast.

We're seeing straws in the wind that a bust could happen sooner rather than later, despite what the economy is telling us. Remember, stocks look ahead and they also lead the economy. So if they sense there's any trouble downstream, like inflation, for instance, they'll be quick to react.

So what are these signs? There are eight signs we feel are important.

#1 and #2: One sign we may be ending the current mania state is the vast numbers of small investors who are buying all sorts of crazy things, driving prices to totally unrealistic levels.

Dogecoin is one example that started as a joke, but there are many others, including the crazy speculation by novice investors in GameStop (GME) and other such stocks.

Over the past year more than 10 million new brokerage accounts were opened, mostly by young men in the past month. This was a record and it’s a sign of a top. Remember, major tops happen when speculation is rampant and that’s what we’re now seeing.

This was an unexpected result of Covid. Young men were stuck at home with time on their hands and a bit of money in their pockets, so they decided to speculate.

#3: This also contributed to our next warning signal… margin debt

People are borrowing to buy stocks and this has pushed margin debt to a record high (see Chart 4). In fact, it’s now higher than it was prior to the last two stock market crashes and this is a big sign of caution.

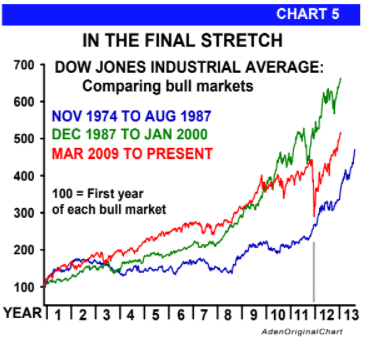

#4: Bull markets compared

Interestingly, if we compare the current bull market to the last two big bull markets, you can see the bottom line on Chart 5. Note, this bull market has now lasted as long, and basically risen as far as the previous bull rises. This tells us the rise is mature and its risen far enough for now.

#5: Divergence

We’re also now seeing big divergences in the market. That is, stocks have been rotating with say Nasdaq the strongest. Then it stalls out and the Transports are the leaders. Then the Dow Industrials and so on (see Chart 6).

This is not abnormal but this time the swings are wider. For example, the Industrials pop up and Nasdaq goes down, and it continues for days or weeks. That’s the difference and it’s another sign the market’s getting toppy.

#6: Indicators telling

Most important is what our leading indicators are telling us. Using Nasdaq as the example with its (long-term) leading indicator, you can see that the indicator has now reached the high area (see Chart 7B). This is a very big deal.

Why? The main reason is because these levels coincide with tops in the market, especially #3 rises (see Chart 7A). And today’s #3 rise is the highest since 2000. And Nasdaq is not alone.

The NYSE, Dow Transportations, AMEX and Russell 2000 indexes are all similar and overbought. The S&P 500 and Dow Industrials are nearing overbought and these are important signs that the end of the bull is near.

We believe Nasdaq is leading and the others will likely follow. Now, this doesn’t mean the market’s going to fall tomorrow. Sometimes a market can stay overbought and keep rising for a while longer. Nevertheless, the point is, the market’s in the final stretch and it’s time to start moving to the exits.

#7: Stocks are expensive

They’re fundamentally overpriced and based on several measures, they’re more expensive than they were at the last two bull market tops. That too is a sign of a top.

#8: Fund managers bullish, hedge funds selling

Fund managers have also put a lot of money into the stock market and they are the most bullish they’ve been in 10 years. At the same time, hedge funds have been dumping stocks. Again, these are signs of a major top.

Overall, if these signs all continue flashing their warning signals, then a bear market decline will soon follow and you’ll want to be out of the market before that happens.

As you know, the world stocks markets generally move together. Some lead and some lag, but eventually they all tend to get into synch and the general trends coincide.

So if U.S. stocks are topping, it won’t be long until the others do too! For that reason, we advise cutting back or avoiding all stocks at this time. They’re becoming higher risk with each passing day and it’s best to steer clear.