Inflation is all over the news these days, and everyone is suggesting ways to avoid its impact on you and your assets, asserts Jim Woods, exchange-traded fund expert and editor of The Deep Woods.

Some market experts are suggesting that Bitcoin and other cryptocurrencies are the way to go, while others have made tried-and-true gold, silver and precious metals stocks their hedges against the effects of inflation.

After all, inflation erodes your purchasing power by requiring you to spend more of your hard-earned money to buy the things that you need and want.

Inflation also reduces the desire for both the public and corporations to invest in the inputs that make the economy hum along. Plus, inflation lowers the value of pensions, savings and Treasury notes, potentially leaving retirees out in the cold financially.

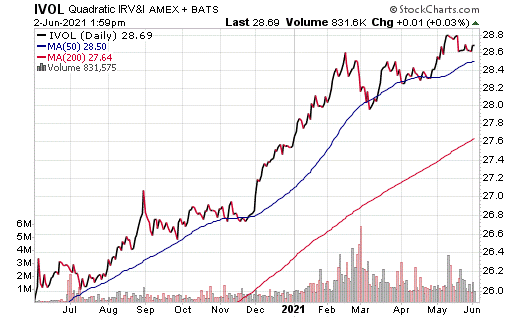

However, what if I told you that there was a way to turn the corrosive effects of inflation into a force that helps, rather than hurts? One potential way to do so is via the Quadratic Interest Rate Volatility and Inflation Hedge ETF (IVOL).

This first-of-its-kind exchange-traded fund attempts to protect against inflation by using Treasury Inflation-Protected Securities (TIPS), TIPS-based ETFs and long options.

While the majority of its assets fall into one of the three categories above, the fund’s managers are also able to invest in both cash and interest-rate swaps that capitalize on a traditional herald of inflation: an anticipated gap, or a steepening, between the 10-year and 2-year Treasury note yields.

Currently, the fund is only invested in three areas: the Schwab U.S. TIPS ETF (SCHP), 85.10%; the U.S. Dollar, 9.79%; and options, 5.11%.

This fund’s performance has been relatively strong, even when including the damage done by the COVID-19 pandemic. As of June 1, IVOL has been up 0.69% over the past month and up 1.83% for the past three months. It is currently up 4.09% year to date.

Chart courtesy of StockCharts.com

The fund has amassed $3.23 billion in assets under management and has an expense ratio of 0.99%, making it more expensive to hold than many other ETFs.

In short, while IVOL does provide an investor with a way to turn inflation into a positive force, this kind of ETF may not be appropriate for all portfolios. Thus, interested investors always should conduct their due diligence and decide whether the fund is suitable for their investing goals.