Inflation is now sweeping the market, cautions Jim Woods, an exchange-trade fund specialist and the editor of The Deep Woods.

In an economy mired in uncertainty, many investors are wary of squandering their investable funds, and risky investments may seem more frightening than thrilling. However, the following exchange-traded fund (ETF) may be able to afford investors some peace of mind.

That fund is the SPDR SSGA Multi-Asset Real Return ETF (RLY), a unique fund that takes a multifaceted approach to combating inflation. RLY combines exposure to inflation-linked bonds with real estate, commodities, Treasury Inflation-Protected Securities (TIPS) and natural resource companies.

Through a fund-of-funds (FOF) structure, RLY aims to achieve real return consisting of capital appreciation and current income. Through its unique structure, the fund manager considers real return to be a rate of return above the rate of inflation.

As it is structured as a fund of funds (FOF), the ETF invests in multiple mutual funds, rather than only single stocks, which can be beneficial as it helps to spread out investment risk even more than owning one mutual fund.

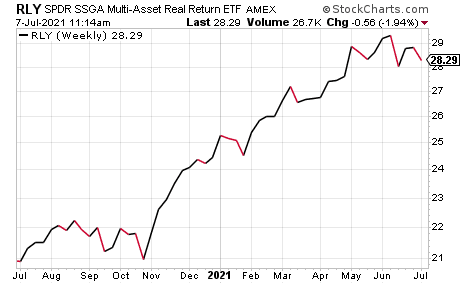

RLY has an expense ratio of 0.50% and a 1.93% dividend yield. The fund has $131.08 million in assets under management and an average daily volume of $1.28 million. Though the fund fell to a low in November 2020, it has progressed steadily higher and is now at the high end of its 52-week range.

RLY’s top five holdings include Invesco Optm Yd Dvrs Cdty Stra No K1 ETF (PDBC), 25.16%; SPDR S&P Global Natural Resources ETF (GNR), 24.61%; SPDR S&P Global Infrastructure ETF (GII), 21.75%; SPDR Blmbg Barclays 1-10 Year TIPS ETF (TIPX), 8.51% and SPDR Dow Jones REIT ETF (RWR), 4.02%.

The fund’s underlying portfolio is evenly balanced, and exposure is split fairly equally among each of the aforementioned asset classes.

Though it is not an ETF that is expected to deliver sky-high gains, SPDR SSGA Multi-Asset Real Return ETF may be a good tool for investors who are worried about preserving their capital, as inflationary pressures are mounting.

Still, investors whose interest is piqued should conduct their due diligence and decide whether or not the fund is an appropriate choice for their investment needs.