You’ve probably been watching home prices rise with amazement. Popular sites like Zillow say my home is worth 60% to 75% more than I paid for it four years ago, observes Nick Hodge, editor of Foundational Profits.

First-time homebuyers are being priced out in many markets as homes routinely sell for above asking price with waived inspections.

Many homes are now being sold off-market. These so-called “pocket listings” are sold through a realtor’s network before a sign even goes up in the front yard.

Inflation, of course, can be pointed to as an overarching reason why. Free money has to go somewhere. But there’s also more to it than that.

There is a nationwide migration underway as locations like Bozeman, Montana become some of the hottest real estate markets in the country, flooded with people who can now work at home with out-of-Montana-type salaries.

There is also a reopening underway from the pandemic. And you have an entire generation of millennials coming of age — the oldest of which are about to turn 40.

There are 90-some million of us (your humble editor is an early-edition millennial minted in 1983) versus 60-some million Baby Boomers. I bought a home to raise my family four years ago. An entire generation now needs to do the same.

You also have private equity money in the housing market, now buying up entire condominiums and neighborhoods in a culmination of everything I just laid out: free money going into hard assets with rising prices with sound fundamentals also behind it.

And like precious metals, the new housing stock is slow and expensive to create, making it a hard asset. The Philadelphia Housing Index, for example, has kept exact pace with the expansion of the money supply over the past two years just like gold has.

All that to say I think real estate prices, on the whole, can continue to go higher. And I want to own more of it.

Not all real estate is created equal of course. There are different types of residential and commercial real estate. I’m more bullish on the former than the latter, especially on the cheaper end of the spectrum.

The longer-term implications of our great nation’s monetary policy are that fewer people have more and more people have less. Don’t shoot the messenger. There are going to be fewer people who can afford to own homes.

In this unfolding real estate situation: you want to be the landlord and not the renter. Real estate as a stock sector is starting to pick up. It’s the third-worst performing sector of the past year but the second-best performing sector of the past three months (after energy).

The traditional way to own that would be through the XLRE Real Estate Select SPDR (XLRE). That gets you exposure to the entire sector: malls, cell towers, housing, public storage, etc.

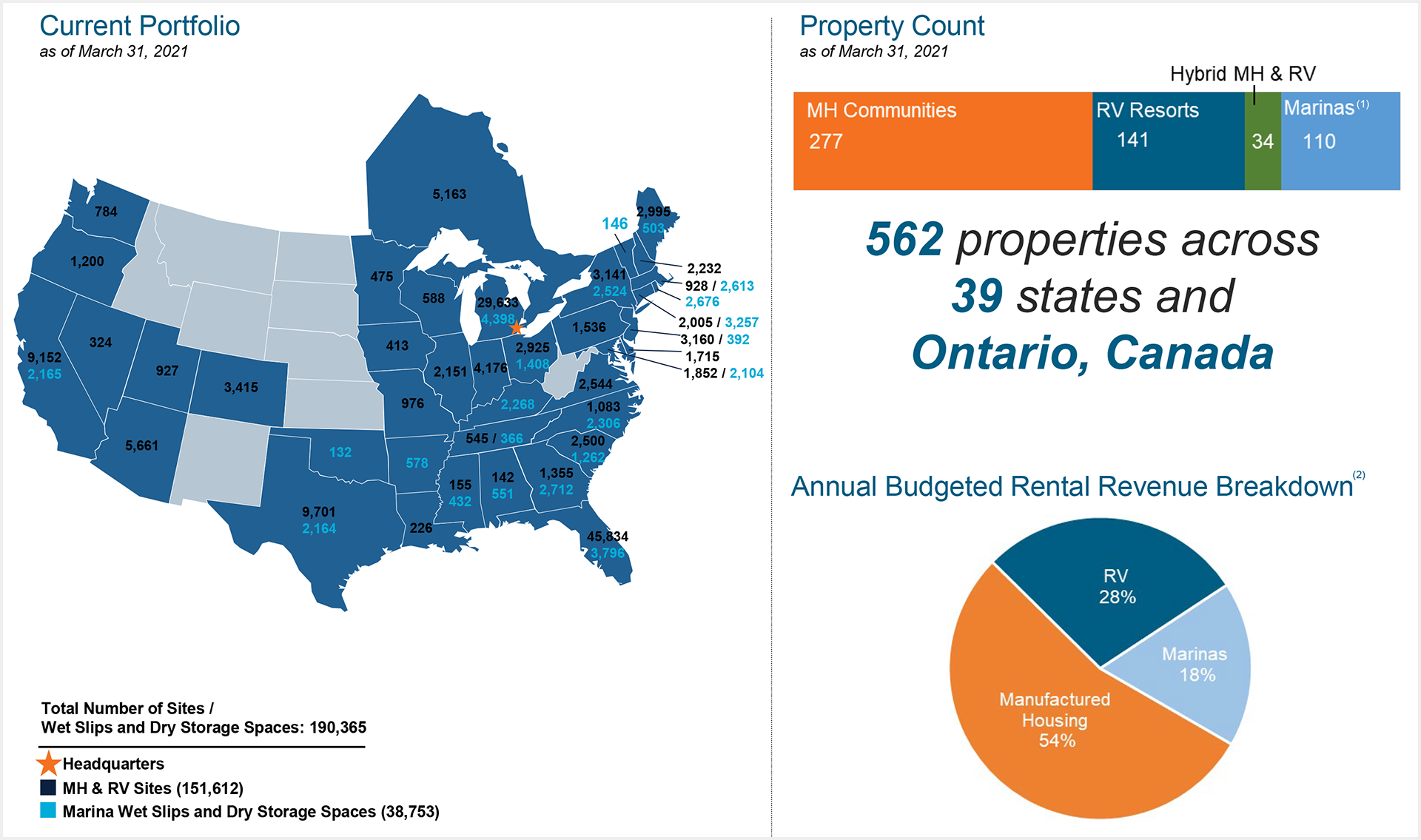

Like I said, I want to drill down a bit. I want to own manufactured housing. Sun Communities (SUI) is a leading owner and operator of manufactured housing communities, RV resorts, and marinas.

It has over 150,000 manufactured homes and RV sites across over 400 communities. It also has over 38,000 marina wet slips and dry storage spaces across 110 marinas. It's a good way to play ongoing themes in real estate.

Not only is affordable housing inventory at historic lows, forcing more people to rent… boat and RV sales are up as a result of people being more flexible to work anywhere and having a bit of extra cash because of stimulus payouts. Buy Sun Communities below $180 as our exposure to the real estate and real estate investment trust sector.