There are many different companies that can give investors exposure to the water business; here, we conclude a review of the 5 best water stocks by Nikolaos Sismanis, contributing editor at Sure Dividend.

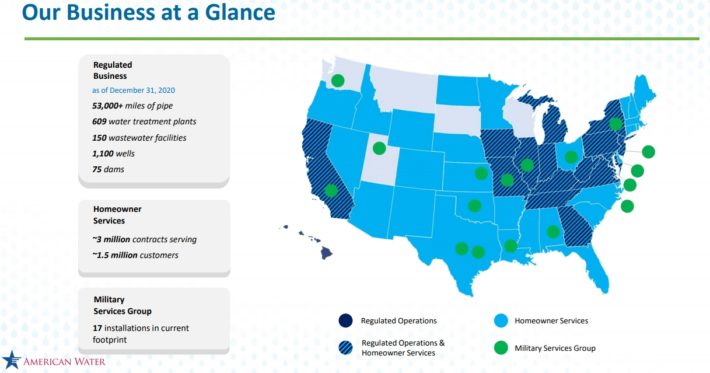

Closing the list of our top water stocks is American Water Works (AWK). While the company may not feature the prolonged dividend growth records that its peers discussed earlier, American Water is the largest and most geographically diverse, publicly traded water and wastewater utility company in the United States, as measured by both operating revenues and population served.

Read Part 1 of this special report here.

Read Part 2 of this special report here.

Read Part 3 of this special report here.

Read Part 4 of this special report here.

The company provides drinking water, wastewater, and other related services to over 15 million people in 46 states. Its regulated business includes 53,000 miles of pipe, 609 water treatment plants, 150 wastewater facilities, 110 wells, and 75 dams.

Source: Investor Presentation

American Water Works has a highly stable and robust track record both in terms of its profitability and its dividend payments.

The company enjoys an extremely resilient business model due to water being a necessity both for residential and industrial usage, as well as a mission-critical asset for the military. As a result, American Water has been able to grow its network and operations with limited risks.

Instead of predicting the company’s future earnings growth, management has already shared its outlook, expecting to grow EPS by approximately 7%-10% annually over the next few years, powered by 5%-7% from regulated investment capex, 1.5%-2.5% from regulated acquisitions, and ~1% market-based businesses. EPS growth includes rate base increases which the company estimates to grow by a CAGR of 7%-8% going forward.

Consequently, we expect solid dividend increases moving forward at around 9% annually, easily supported by the company’s underlying profitability.

American Water Works currently features a healthy payout ratio at around 57%. Due to its vastly diversified operations and predictable future cash flows, it should continue growing its earnings and dividend income for its investors for decades to come.