The market looks like it's about to fall apart. Which means we contrarians will step in, and smartly bank more dividend for our dollar, cautions Brett Owens, chief investment strategist at Contrarian Outlook.

Some of us park our dry powder in cash. Others stash in conservative bond funds to juice a bit more yield out of our savings. Let's talk about these bonds because this is an ideal time to say goodbye to them (for a while!)

As dividend investors, we are naturally allergic to cash. After all, why leave money in dollars earning nothing when we can move it to a stock or fund yielding something?

As we went to print, the 10-year yield has dipped to 1.2%. This short-term move does not negate the presence of this long-term floor.)

The consumer price index (CPI) is up 5.4% year-over-year. And this number is probably understated because it doesn't include housing prices, which have soared 24% over the past year!

With 5.4% inflation and a 1.2% 10-year rate, something has to give. Which is another reason I'm expecting real yields to rise. So, with the 10-year yield at a multi-year floor, I don't think it's worth reaching for cash alternatives.

A better bond bet — whether rates are rising, falling or grinding sideways — is the DoubleLine Income Solutions Fund (DSL). It has several major advantages over an ETF.

First, the fund pays a juicy 7.5% today. The 10-year yield could double and it would still be no competition for the DoubleLine fund.

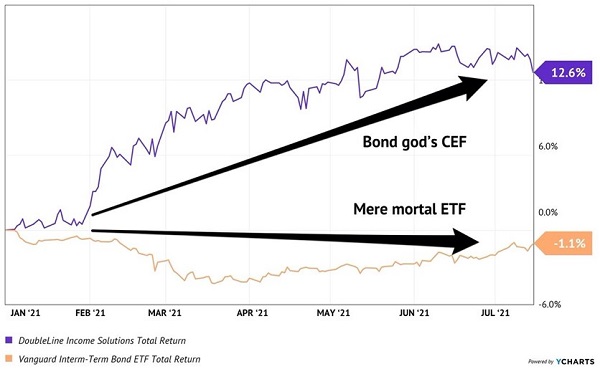

Second, DSL is managed by the "bond god" Jeffrey Gundlach and his all-star fixed income team. He's called that because Gundlach took the bond crown from Bill Gross many years ago thanks to consistent outperformance.

His team at DoubleLine scours the world for the best bond deals. No wonder three of their top five holdings are overseas offerings that we mere mortals can't access. Oh - and they have coupons above 7%!

Third, when we entrust our capital with the bond god, we are able to do so at a discount to net asset value (NAV). As I write, DSL trades at a 3% discount to NAV. Why? No idea. But I'm happy to buy world-class expertise for 97 cents on the dollar. I expect the outperformance to continue, regardless of where rates go.