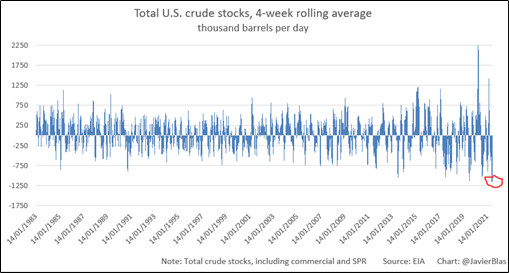

Here in the U.S., crude oil stockpiles are low and getting lower, falling six weeks in a row. Recently, we had the biggest four-week draw-down on oil stocks that America has seen in the last 40 years, asserts Sean Brodrick, editor of Wealth Megatrends.

What’s more, global oil demand is on course to return to pre-pandemic levels by the end of 2022, rising by 5.4 million BPD in 2021 and another 3.1 million BPD next year. That’s according to the International Energy Agency (IEA). And each successive report of oil demand beats expectations.

Over the next year, it would still be a struggle to keep up with surging demand. My play on this tend is ConocoPhillips (COP). It’s a major oil producer and a great stock. And this recent sell-off is giving you a good buying opportunity.

Conoco has a strong presence in Lower 48 major acreage areas that comprise prolific shale plays like the Permian Basin, Bakken and Eagle Ford. It also has an opportunity in Alaska the market is ignoring — for now.

Management recently issued an ambitious 10-year operating plan focused on efficiency, highlighted by the reduction of 2021 capital expenditure by $200 million from the previous estimate of $5.5 billion.

Also, it expects adjusted operating costs to decrease by $100 million from the prior estimate to $6.1 billion. Despite this, Conoco anticipates 3% compound annual growth in production. Talk about squeezing more profit out of every penny.

Due to the pandemic, Conoco actually lost money last year. This year, it’s projected to earn $3.88 a share. That’s an increase of 500%! Sweet! Management will report second-quarter financial and operating numbers on Aug. 3. I expect good news.

Last year, Conoco acquired Concho Resources with its rich Permian Basin properties. Combining the two companies will save $1 billion a year in operations. Because of its focus on reducing costs, ConocoPhillips can generate significant cash flow from operations, even at lower oil prices. It has $7.3 billion in cash sitting on its books, so it could easily make more accretive acquisitions going forward.

Conoco also announced it was increasing its share repurchase program. It intends to boost stock buybacks by $1 billion for 2021, which is in line with its plan of returning 30% cash from operations to its shareholders. It resumed the share repurchase program in March at an annualized level of $1.5 billion. The latest buyback move is likely to bring the total 2021 planned distribution (including dividends) to $6 billion.

In 2020, Conoco was the top oil producer in Alaska with average daily production of 198,000 barrels of oil equivalent per day. Alaska oil gets Brent prices, which is higher than the West Texas Intermediate (WTI) price. Nice!

Conoco is developing the massive Willow Field in Alaska, which is currently estimated to contain 400 million to 750 million barrels of oil equivalent of recoverable petroleum. It will be producing for more than a decade.

Conoco is the largest supplier of oil to the Trans Alaska Pipeline System (TAPS), and TAPS is running low on product. At a certain point, without new oil input, TAPS would have to shut down. And it would take many fields in the Lower 48 to replace that oil.

It doesn’t hurt that Conoco has a 29.61% ownership stake in the TAPS pipeline. So, when Willow starts pumping, the company will get more higher-priced oil out of Alaska and stay on the president’s good side.

ConocoPhillips sports a dividend yield of 2.9%. That payout is projected to grow 3.57% per year for the next three years. Not bad at all! You can see how Conoco pushed through serious resistance and continues to trend higher. My target is $78 a share, for starters. As management cuts costs, raises the dividend and buys back shares, COP could go much higher.

Are there risks? The biggest is a resurgence of the coronavirus and how that could affect the global economy. But let’s say ConocoPhillips falls down the stairs on bad news. You’ll be paid a fat and growing dividend for it to pick itself up again.