Medicine has come a long way in the last few decades, and that pace shows little sign of slowing, explains Jim Woods, an exchange-trade fund specialist and the editor of The Deep Woods.

The cutting edge of medicine is leaping and bounding into the future, and there is a potential investment theme here that could be wildly profitable. So, how can individual investors like you and me profit from this trend?

Well, one way is ARK Genomic Revolution ETF (ARKG). This exchange-traded fund (ETF) invests in companies related to a range of exciting technologies in the biotech and medical areas. As the name implies, the focus is on scientific developments in the genomics field for this fund.

These technologies are expected to enhance the quality of human life, such as by allowing for gene editing to prevent certain genetic diseases.

Some of the technologies involved here are: CRISPR, targeted therapeutics, bioinformatics, molecular diagnostics, stem cells and agricultural biology.

Each of these developing technologies has the potential to bring revolutionary change to their respective fields. The fund can hold both domestic and foreign investments across multiple sectors so long as the companies held are relevant to these exciting themes.

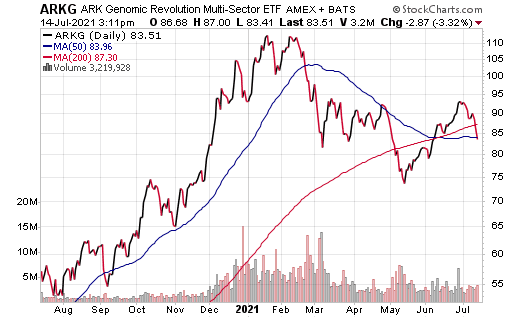

This fund’s recent performance has been a bit disappointing, which may make for a strong entry point. For the last year, the fund is up 54%, still considerably better than the S&P; however, much of those gains came last year, and so ARKG’s year-to-date performance is an underwhelming -10%.

The expense ratio for this fund is 0.75%, which is somewhat high, but it makes sense that an actively managed fund might charge more of a premium. There is no dividend.

Chart courtesy of www.StockCharts.com

The top holdings for ARKG include Teladoc Health Inc. (TDOC), 6.82%; Exact Sciences Corp. (EXAS), 4.94%; Regeneron Pharmaceuticals (REGN), 4.49%; Pacific Biosciences Corp. (PACB), 4.37%; and Caredx Inc. (CDNA), 4.09%.

Roughly 42.32% of the fund’s net assets of just under $10 billion are invested in the top 10 holdings, which makes it relatively concentrated for an ETF.

Currently, there is a total of 60 holdings, with a few of those positions being extremely small. The fund is actively managed, and so the holdings don’t necessarily correspond to a market cap weighting strategy.

If investing in cutting-edge biotech strikes you as an interesting strategy, ARK Genomic Revolution ETF may be one fund you could consider for your portfolio.