I’m recommending little-known Pershing Square Holdings Ltd. (PSHZF) of the Netherlands; this is Bill Ackman’s largest investment vehicle, structured as a closed-ended fund with about $10 billion of net assets, notes Carl Delfeld, a leading international investing specialist and editor of Cabot Explorer.

Ackman, a well-known value investor, founded Pershing Square Capital Management in 2004 with $54 million, much of it his own money.

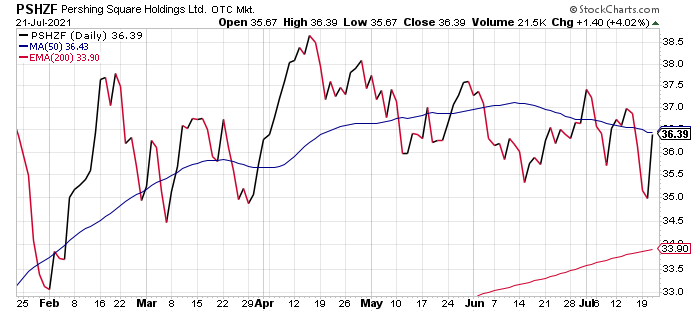

Pershing Square Holdings shares trade around $36, a 27% discount to their most recent weekly net asset value of close to $50 a share. American investors can buy Pershing Square Holdings on Euronext, the London Stock Exchange, or through a U.S. Pink Sheet listing under the ticker PSHZF.

The U.S. shares offers decent liquidity with an average daily volume of about 50,000 shares though some brokerage firms may restrict the ability of U.S. investors to buy shares of the fund because of its offshore status.

Pershing Square Holdings has a concentrated portfolio of about 10 stocks, such as Lowe’s (LOW), Hilton Worldwide (HLT), Chipotle (CMG), Howard Hughes (HHC) and Domino’s Pizza (DPZ).

Unlike a mutual fund, a closed-end fund trades on an exchange — like a stock — and can sell for more or less than its net asset value (NAV).

From the fund’s 2004 inception through the end of last year, investors multiplied their investment 15X, versus the fivefold return they would have achieved in a zero-cost S&P 500 index fund. Pershing Square Holdings returned 70% in 2020 after gaining 58% in 2019.

Ackman adroitly hedged the Pershing portfolio with credit-default derivatives before the pandemic, which offset equity losses during the market downdraft in March 2020. This is exactly what you want a hedge fund to do to earn its hefty performance fees of 16% of the profits.

One major positive is that Ackman is the largest holder of Pershing Square Holdings with a 21% stake worth $1.5 billion. One drawback with Pershing Square Holdings is that it is classified as a passive foreign investment company, which requires U.S. holders to file an IRS form 8621. This could cause some tax hassles for investors.

But the big discount on the fund and the opportunity to invest with a successful investor like Ackman offsets that minor headache as he looks for situations with asymmetrical risk: lots of potential upside and limited downside, and he prefers to hold positions for several years.

In short, Pershing Square Holdings allows you to access the skills of one of the world’s most successful hedge fund managers—– one who uses investment strategies and techniques you cannot replicate — at a significant discount to the net asset value of the holdings in the fund.