While the Delta variant of COVID-19 is getting all the headlines right now, the frontiers of biotechnology are not solely confined to treating the outbreak of this pathogen, notes Jim Woods, an exchange-trade fund specialist and the editor of The Deep Woods.

Indeed, a great deal of effort and money is being poured into developing treatments for genomic diseases like cystic fibrosis.

As there are many genomic-related biotech companies out there, each claiming to have the next “big cure” for the disease du jour, some investors might want to turn to the Global X Genomics & Biotechnology Exchange-Traded Fund (GNOM) as an alternative to owning possibly volatile individual biotechnology stocks.

The stocks in this exchange-traded fund’s portfolio are selected from a list of companies that obtain more than 50% of their revenue from gene editing, genomic sequencing, the development and testing of genetic medicines, computational genomics or biotechnology.

To calculate this figure, the fund uses a natural language processing algorithm that scans public documents, including filings and disclosures, and then makes the necessary selections.

Currently, the fund’s top holdings include Intellia Therapeutics (NTLA), Alnylam Pharmaceuticals (ALNY), Genscript Biotech (HKG: 1548), Agilent Technologies (A), QIAGEN NV (QGEN), CareDx, Inc. (CDNA), Natera (NTRA) and BioMarin Pharmaceutical (BMRN).

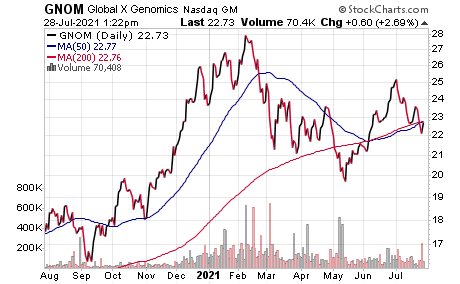

This fund’s performance has been relatively mixed, even when including the damage done by the COVID-19 pandemic. As of July 27, GNOM was down 7.68% over the past month and down 6.03% for the past three months. It is currently down 6.31% year to date.

Chart courtesy of www.stockcharts.com

The fund has amassed $244.2 million in assets under management and has an expense ratio of 0.50%.

While GNOM does provide an investor with a way to profit from genomic technology, this kind of ETF may not be appropriate for all portfolios. Thus, interested investors always should conduct their due diligence and decide whether the fund is suitable for their investing goals.