The decline in rent collections and the slow climb back to "normal" explains why REITs were down so much in 2020, and were slower to recover than the broader market, observes income expert Rida Morwa, editor of High Dividend Opportunities.

However, with Q2 earnings around the corner, most REITs will be reporting near 100% collections. Additionally, tenants who missed rent payments are paying back rent, meaning that many REITs are seeing rental collections in excess of 100%.

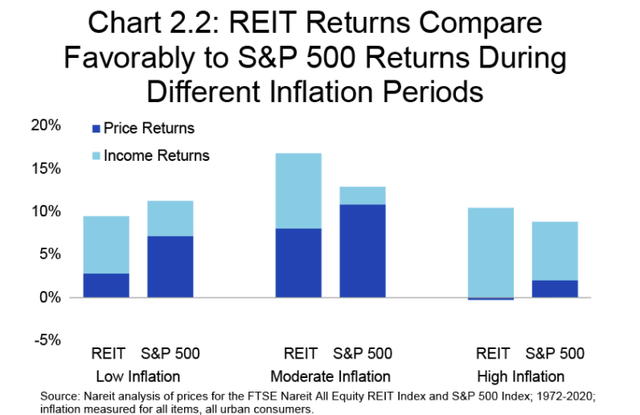

What does the future hold? Well, if the latest couple of months are any indication, and we believe they are, the future holds inflation. Here is a look at how REITs perform in inflationary times.

Historically, REITS have outperformed the S&P500 in times with moderate to high inflation. The best part is, that much of the return from REITs comes as dividends paid to the investor.

Real estate provides owners with an excellent hedge against inflation in two ways. First, they collect higher revenues. REITs increase rent through new leases, and "escalators" that increase rent regularly are commonly built into longer-term leases.

Additionally, in an inflationary environment, the value of real estate also grows. Real estate is often seen as a "safe haven" from inflation as a physical asset. These factors drive REITs to outperform the broader market during inflationary times.

We want to own REITs, and we want broad diverse exposure but we don't want to own every REIT. A closed-end fund or CEF, is an attractive option. Unlike ETFs, which simply buy every stock that meets a predetermined formula, CEFs are actively managed.

The manager is actively buying and selling, avoiding high-risk investments while investing in winners. A CEF that uses modest leverage to boost returns, makes a lot of sense in this environment. We have two such funds from one of our favorite fund managers in the REIT sector: Cohen & Steers.

Cohen & Steers REIT & Preferred Income Fund (RNP) is a closed-end fund that holds 261 positions. As its name implies, it holds both REITs and preferred shares.

Since the banking sector is the largest issuer of preferred shares, the preferred portion of the portfolio has a large exposure to banks.

In the REIT portion of the portfolio, the healthcare sector is a hot one where we expect plenty of growth over the next few years. Infrastructure, Industrial, and Data centers have done well and should continue to outperform. Self-storage has short lease terms which should help them deal with any inflation by quickly passing along increases to customers.

For the last 10 years, RNP has not cut the distribution and has had multiple distribution increases. In 2016, the fund switched from a quarterly distribution of 37 cents to a monthly payment of 12.40 cents which on an annual basis was a slight increase ( from $1.48 to $1.488). RNP has been a reliable dividend payer.

RNP — which now yields 5.7% — uses leverage around the mid-20% level. Given the high amount of preferred shares in the portfolio, this helps juice the returns while not having a very high volatility level.

Cohen & Steers Quality Income Realty Fund (RQI) has only 154 holdings and so is more concentrated than is RNP. Its holdings look a lot like the REIT portfolio of RNP.

Much like RNP, RQI has not cut the distribution over the last 10 years either. Instead, it has had several distribution increases, with the most recent increase in 2015. In October of 2016, RQI switched from a quarterly distribution of 24 cents to a monthly distribution of 8 cents, keeping the same annual total distribution.

Overall, RQI has ever so slightly outperformed RNP over the past 10 years. However, it has done so with a higher level of volatility. This makes RQI an attractive option for more aggressive investors who want exposure to REITs heading into inflationary times.

RNP is a more attractive option for investors who prioritize lower volatility. The preferred shares in the RNP portfolio helps reduce some of the downswings.

RQI, much like RNP, uses leverage in the mid-20% range. At 2.2%, its fees are a bit higher than RNP, but about half of that is used to pay for the leverage the fund uses. And as always, the 6.0% yield is net of all fees.

RNP and RQI are two funds that will be able to take advantage of the improving REIT sector. And with the modest amount of leverage they use, they provide investors an added boost of income.

Both RNP and RQI are trading around a 5% discount to NAV, giving an additional boost to the yield and providing an attractive entry point. You can collect high-yield and hedge your portfolio against inflation at the same time!