A covered call is a popular and conservative strategy that many investors employ to generate additional returns on their stock holdings, explains Nancy Zambell, editor of Financial Freedom Federation.

For every 100 shares of a stock in your portfolio you can sell one call against that security. In exchange for limiting your upside potential to the strike price of the call you’ve sold you’ll collect income from the contract.

Percentage returns vary widely based on volatility and strike price, but even low-volatility out-of-the-money call writing can generate reliable double-digit returns.

You can implement a LEAP option strategy that replicates the effects of a covered call strategy with a lower capital outlay by using a diagonal spread.

A diagonal spread can be used with any options, but when used as a LEAP option strategy it typically involves buying a long-term LEAP contract on a security and subsequently selling shorter-term contracts against that same position.

This LEAP option strategy can be implemented in flat markets, bullish markets or bearish markets, depending on whether you’re using call or put diagonal spreads.

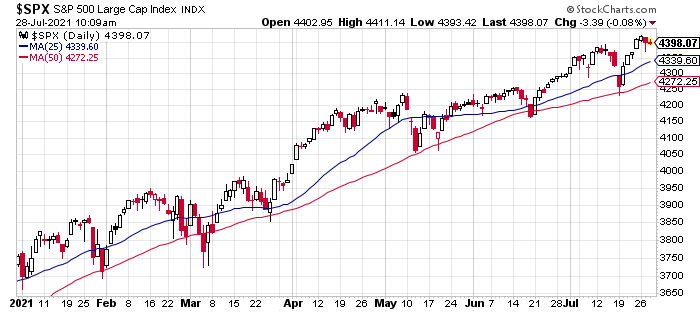

As you can tell from the chart below, we are in a textbook bull market right now (at least as measured by the large-cap S&P 500).

This is considered a “textbook” bull market because the S&P 500 is consistently hitting higher highs while also experiencing higher lows. The index has also consistently found support at its (rising) 50-day moving average, which is another bullish indicator.

If we want to implement our diagonal spread LEAP option strategy, we’ll need to pick two contracts, a long LEAP call and a short call.

Diagonal Spread LEAP Option Strategy Step #1: Buying the LEAP

As previously mentioned, you can implement a diagonal spread on short-term options as well as LEAPs, but we’ll use LEAPs to maximize the time that we’ve got to apply the strategy. Specifically, we’ll be looking at the January 20, 2023 SPY calls.

Next, we’ll pick a strike price. Round-number strike prices tend to attract more liquidity, so that’s a good place to start. The appropriate strike price will vary by investor, but as a general rule, the lower the strike price, the higher your initial outlay and the lower the premium.

Let’s look at two in-the-money calls and break down how they affect our LEAP option strategy. The 350 call meets the general liquidity criteria and currently has a bid-ask spread of 99-104.

This means your initial costs will be $9,900 – $10,400; for this example, let’s assume you’re able to somewhat split the difference and buy your LEAP at 102. That makes your breakeven on SPY 452, a roughly 3% premium for 18 months of time.

Alternatively, if we look at the 400 call (also offers liquidity) we have a spread of 60-65, which puts your initial cost between $6,000 and $6,500. Assuming you can get some price improvement, let’s use a fill price of 63, which makes your breakeven on SPY 463 (a 5.5% premium).

The lower strike is more expensive, but more of the cost is allocated to intrinsic value and less of it to premium; the right choice is up to you.

Diagonal Spread LEAP Option Strategy Step #2: Selling a Call

The next step in this LEAP option strategy is identifying and selling a call against the lower-strike LEAP. When picking your call, keep in mind your breakeven and your expectations for the market going forward. Let’s assume we bought the 350 LEAP at 102 and our breakeven is 452.

Looking out to September of 2021, we need to find contracts with reasonable liquidity where the strike price + premium received is greater than our breakeven. The 450 technically meets those criteria since you’d receive a premium of $3.75 per contract.

However, a continued bullish trend in large caps would increase the odds that the trade is executed and would generate a paltry 1.7% over a month and a half. That’s $10,000 (difference between short and long strikes x 100) + $375 (contract price x 100) divided by your initial investment of $10,200.

A better strike for our LEAP option strategy would probably be the 455, which is currently trading just north of $2.10 per contract. If the market remains bullish and shares are called away at 455, you’d generate 5% in the same timeframe ($10,500 difference between strikes + $210 premium divided by $10,200 initial investment).

If the trade isn’t executed, you’ve generated $210 that you can either treat as income or use to offset part of your initial investment and lower the breakeven. Plus, you’ll still be long the LEAP and can look another month or two out to sell another call.

The best-case scenario would be the SPY trading just below our short strike (455) at expiration because you’ll have appreciation + income.

Picking the right short strike is a matter of your expectations for the market in the next 1-2 months but make sure to always keep your breakeven in mind. Also, remember, even though you’re selling calls this LEAP option strategy is a bullish position; if you’re not bullish on the market this isn’t the right trade.