Six mega-cap tech companies dominate the market right now, explains Adam Johnson, editor of Bullseye Brief — and a participant at the MoneyShow Las Vegas, Sept. 12-14. Learn more here.

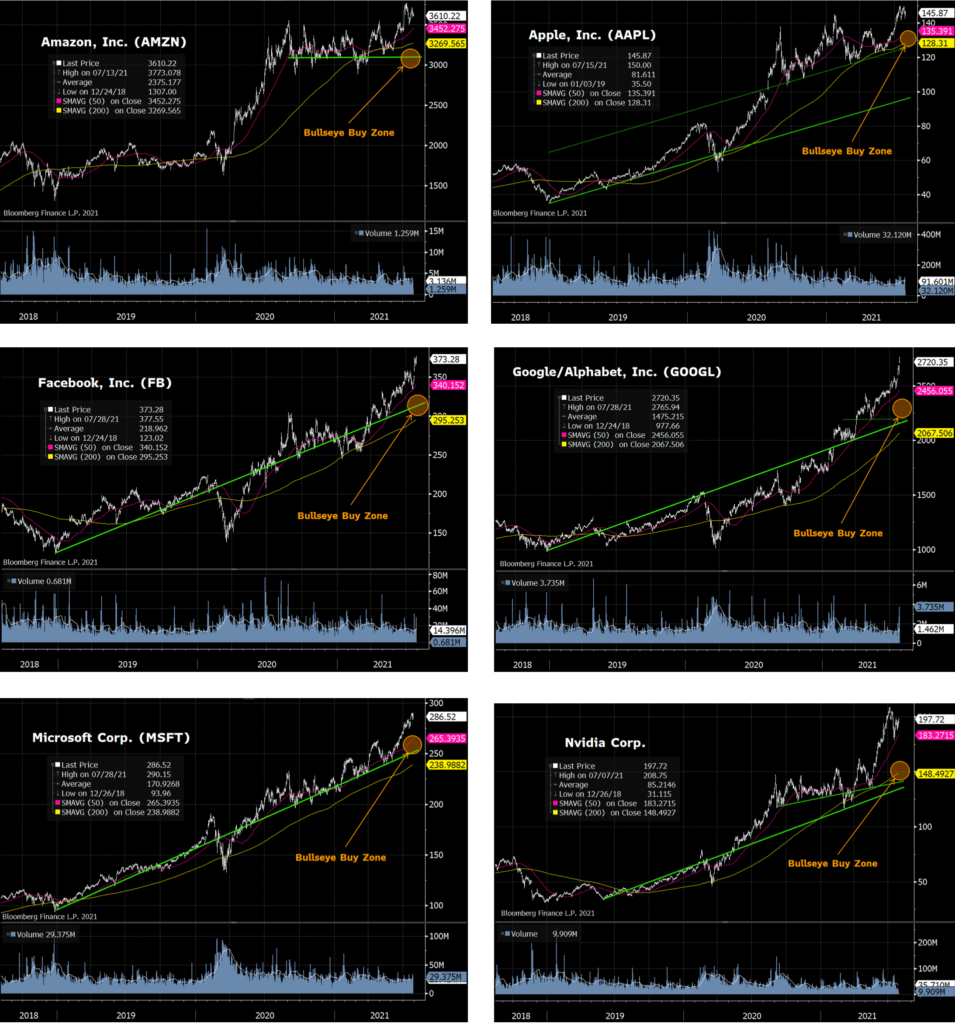

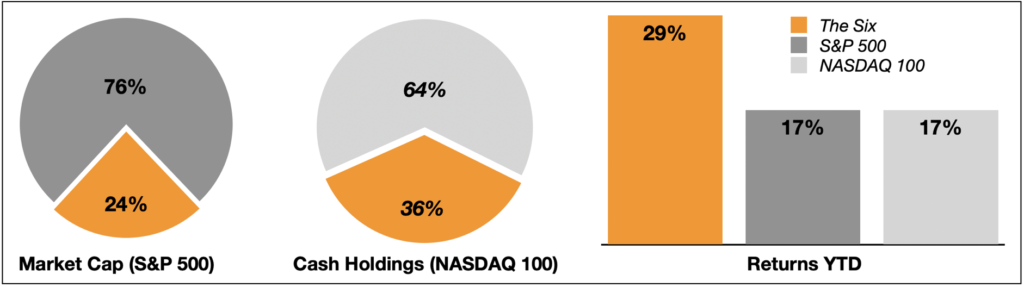

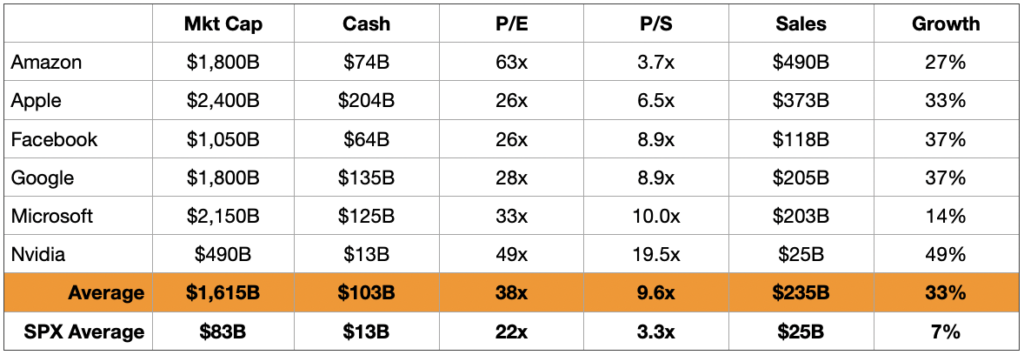

We all know them: Amazon (AMZN), Apple (AAPL), Facebook (FB), Google/Alphabet (GOOGL), Microsoft (MSFT), and Nvidia (NVDA). Their combined capitalization of $9.5 trillion represents nearly a quarter of the S&P 500 Index, which equates to a staggering 45% of US GDP… again, just six stocks

I am not long them, though I certainly wish I were. They are up about 29% YTD, primarily because they provide consistent growth at scale. Whereas last year stocks rallied from Covid lows virtually across the board, this year is more about sure bets.

My small cap growth stocks hold great promise down the road (and I think we’ll make multiples on our money), but The Big Six provide great results today.

I am digging into each one of them to better understand how their business might evolve, with the goal of identifying where I’d buy them should markets correct 8-10% at some point. As great examples of American Ingenuity, they could all become Bullseye picks, but only at the right price.

Amazon

Anything, anytime, anywhere at the lowest price … plus AWS.

2Q Results — Huge earnings beat, but a surprising revenue miss and lower guidance as consumers appear likely to return to brick and mortar stores. While Amazon has beaten estimates by 60-600% each quarter since the pandemic began, Q2’s beat slipped to “just” 23%.

Guidance — Sees Q3 sales of $106-112B, about 8% below consensus estimates of $119B. That said, 20-30% topline growth is still quite strong. Only Wal-Mart (WMT) sells more merchandise.

What to Watch — Rising wage pressures, and how new CEO Andy Jassy demonstrates leadership as Jeff Bezos departs, especially since he’s the one who lowered guidance for the first time in several years. Separately, the company is exploring whether to integrate cryptocurrency into its payment’s options.

CEO Quote — Thank you to all of our passionate, innovative, mission-driven employees around the world for continuing to stay focused on delivering for customers. I’m very excited to work with you as we invent and build for the future.

Valuation — Cheapest P/Sales multiple of the group at 3.7x, though not surprising since retailing margins are typically very low. Amazon Web Services (AWS) would probably trade many multiples higher as a stand-alone business. AWS enables two-thirds of internet e-commerce and is growing 37%… but it’s only 12% of total Amazon revenue.

Buy Zone — $2,900-3,200

Apple

Because everything works out of the box and looks beautiful.

2Q Results — Largest 2Q profit ever at $21.7B, led primarily by 5G iPhone upgrades. Apple topped analyst estimates by nearly 30%, which has only happened 12 times in 20 years. Curiously, the stock traded down 3% the next day based on conservative commentary around chip shortages.

Guidance — Management again refrained from providing guidance, a practice begun by CEO Tim Cook in 2019 as he implored analysts to start thinking about Apple as a “services provider” rather than as a “goods manufacturer.”

What to Watch — The iCar will be an iconic game-changer and a direct challenge to Tesla… yes, I think it will happen. International growth of the core iPhone franchise could double earnings, though simmering US-China tensions are a potential threat sales and production.

CEO Quote — We ask ourselves if we can do something better. We’ll only enter a market where we have an ability to make a better product for the user.

Valuation — P/E is 26x for both 2021 and 2022, since earnings estimates are flat YoY, which seems crazy but probably reflects an assumption that lockdowns brought demand forward by several quarters.

Buy Zone — $125-135

Because it’s where 2.9B people connect all day long.

2Q Results — Handily beats estimates on record Q2 revenue growth of 56% YoY… $29B in just three months. Notably, ad prices rose 47% YoY, though ad volume increased only 6%. Advertising represents 98% of revenue.

Guidance — Cautious on 3Q because comps will get harder, as last March marked the bottom and growth was already on the upswing. Additionally, Apple’s new iOS will allow users to activate an ad-blocking filter, which may disrupt revenues… this is why potential new profit sources are key (think merchandise sales and money transfer).

What to Watch — Near term, monetization of Instagram is job #1… adding One-Click-to-Pay and taking a percentage of sales for example. Long term, Mark Zuckerberg talks of creating a virtual/augmented reality Metaverse, where people would interact with one another real-time in digital environments. The Libra cryptocurrency project has lost momentum, but money transfer could be big.

CEO Quote — I’m excited to see our major initiatives around creators, community, and commerce… and building the next computing platform that will bring our vision of the metaverse to life.

Valuation — Nearly every analyst on the Street raised estimates/targets following earnings, despite management caution about lower growth for the second half of the year. Shares trade at a P/E of 26x, consistent with the past several years. EPS may grow 40% this year but retreat to the long-term trend of 15% by 2022.

Buy Zone — $300-325

Google/Alphabet

Because they own the internet. Period.

2Q Results — Highest-ever quarterly revenue and profit, powered by record online ads sales. Ads related to Search rose 69% YoY to $36.6B, YouTube ad sales rose 84% to $7B and Cloud revenue rose 54% to $4.6B.

Guidance — No specific guidance offered, but management says comps will be tougher for 3Q despite rising ad sales, since higher Capex and decreasing FX tailwinds will pressure operating margins.

What to Watch — Global efforts to tax Google revenue. The company can certainly afford to pay proposed EU taxes, but the stock could be vulnerable to a headline-driven downdraft.

CEO Quote — We’re seeing a rising tide of online consumer and business activity in many parts of the world, and we’re proud that our services help so many businesses and partners.

Valuation — P/E is 28x with 10-15% eps growth… expected in perpetuity.

Buy Zone — $2,200-2,400

Microsoft

Because every corporation in the world needs them.

2Q Results — Tenth consecutive earnings beat driven by the highest-ever quarterly sales, which rose 21% to $46B. Notable new business wins highlight the mission-critical relevance of Azure Cloud Services and Windows 365 for enterprise users. Personal gaming and device revenues rose above $14B for the first time, and LinkedIn advertising surpassed expectations.

Guidance – CFO Amy Hood sees “healthy double-digit revenue growth for the fiscal year ahead.”

What to Watch – Azure Cloud is a huge growth driver, but analysts are quick to highlight caution on the part of management… which may reflect C-suite concern that Wall Street had gotten ahead of itself.

CEO Quote – We continue to grow new franchises for Microsoft in large and growing markets. In the past three years alone, gaming, security and now LinkedIn have all surpassed $10 billion in annual revenue.

Valuation – P/E is little pricey at 33x, given 10-12% growth, and P/Sales is historically high at 10x (vs. 10-yr avg of 6x).

Buy Zone – $250-260

Nvidia

Because they make the fastest chips in the world 3T calculations/second.

2Q Results — Will be announced 8/18. Analysts currently expect earnings per share of $1.02, which would be a 100% increase YoY, driven by a record 65% increase in revenue to $6.3B (also a record). The company has beaten estimates ten quarters in a row, but current expectations seem especially high.

Guidance — Everything I’ve read suggests to me that demand far exceeds supply, and that the company’s ultrafast chips have no real competition… especially for fast-growing, high-intensity applications like A.I . and crypto mining.

What to Watch — Can Nvidia beat elevated expectations yet again? Have unprecedented 26-week lead times contracted? What’s the status of DoJ’s review of the proposed $30B ARM acquisition?

CEO Quote — We see great strength right now, and it’s growing strength… setting us up for years of growth. Data Center, and A.I. specifically is the largest segment of computing. It’s going to grow for some time to come (5/26).

Valuation — Very expensive… P/E is 49x and P/Sales is 19.5x… leaving no room for disappointment.

Buy Zone — $140-160