Eaton Vance Tax-Advantaged Global Dividend Opportunities Fund (ETO) is a closed end fund (CEF) that focuses on providing investors tax-advantaged distributions, asserts Rida Morwa, income expert and editor of High Dividend Opportunities.

Eaton Vance Tax-Advantaged Global Dividend will invest at least 80% of its total assets in dividend-paying common and preferred stocks from both foreign and domestic sources.

ETO provides tax-advantaged distributions to shareholders with the majority of its dividends being classified either as "long-term capital gains" or as "qualified" dividends. This makes ETO particularly attractive for investors looking to manage their tax obligations in a taxable account.

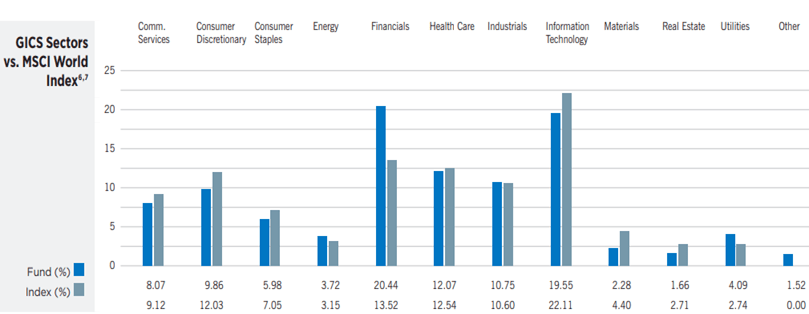

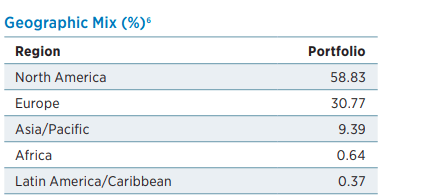

ETO primarily invests in North America and Europe, representing approximately 89% of assets. These are the geographies we are the most bullish on. ETO is also overweight on financials, which are set to benefit from rising long-term rates.

Over the long run, ETO has provided market-beating returns, outperforming the S&P 500 through both the Great Financial Crisis and COVID.

ETO is currently trading under a 3% premium to NAV, and the best part is that NAV is near all-time highs. ETO has already raised its dividend once this year, and with NAV continuing to climb, we could see another raise or a special dividend at year-end.

With exposure to mega caps around the world, ETO is a great way to gain exposure to picks that generally do not fall in the HDO wheelhouse, while having those returns converted into a tax-efficient income!

The fund has provided strong performance and withstood the test of time — ETO has 17 years under its belt and USA running with the market for 31 years! This combination of strong performance for decades, diversification from the bulk of our portfolio holdings, and the high yields we seek make both of these CEFs worthy of consideration to "buy and hold forever".