TriplePoint Venture Growth (TPVG) is a high-quality BDC (business development companies). We are very bullish on BDCs and already hold several great ones in our portfolio. So why add another? asks Rida Morwa, editor of High Dividend Opportunities.

In terms of broad strategy, TPVG is similar to many other BDCs. They make primarily debt investments consisting of first-lien, senior secured loans, allowing them to collect regular interest income.

Then they add an equity "kicker", which provides upside potential when the borrower is acquired, grows, or has an IPO. This is a strategy employed by many BDCs to invest in small to medium-sized businesses and ensure attractive returns.

While TPVG has a lot of similarities to other BDCs that we love, it also has a few things that make it a bit different and diversify our portfolio.

First, TPVG invests at the "venture growth" stage of companies that have already attracted substantial investments from venture funds. These companies have already raised capital and have investors interested in pushing the company to a liquidity event such as an IPO or an acquisition.

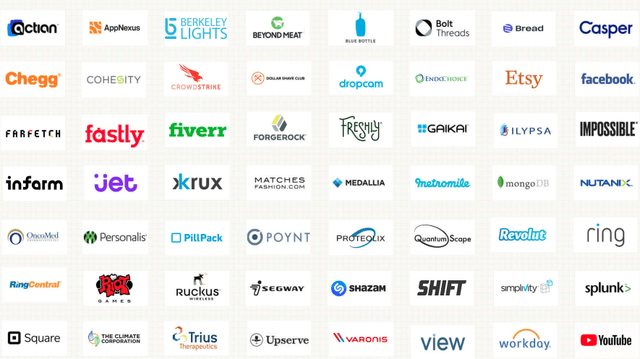

Second, TPVG has a very high allocation to the tech sector and emerging consumer brands. This has led TPVG to be invested in many of the most well-known brands to have come about in the past decade:

Source: TPVG Investor Presentation

TPVG provides an opportunity for us to benefit from the substantial upside of pre-IPO investing in up-and-coming companies while also achieving our high-yield objectives for our portfolio.

The power of this strategy was on full display in Q3 when TPVG saw its largest quarterly growth in NAV ever. A 6.8% increase from $13.03 to $13.92 in a single quarter.

TPVG portfolio companies ForgeRock, Inc. (FORG) and Toast, Inc. (TOST) both completed IPOs. Another portfolio company, Nerdy, Inc. (NRDY), closed its SPAC merger. It was a very busy, and very profitable quarter for TPVG.

The best part is that TPVG isn't slowing down. Rent the Runway (RENT) and Enjoy Technology (ENJY) also had liquidity events after the end of the quarter, providing more upside that will be quantified at Q4 earnings. TPVG realized substantial gains in Q3, and we can expect more gains ahead.

These factors diversify TPVG from our other BDC picks, focusing on different sectors and investment stages. We expect a big upside potential for this stock in addition to the very generous yield of 7.6%. TPVG has proven that it can consistently make great picks at the venture growth stage and will continue to be an excellent steward of our capital.