We love cookie-cutter stories — retail firms with a proven product or service that can grow their business many-fold simply by opening up more locations, explains Mike Cintolo, editor of Cabot Growth Investor.

Such a business model remains powerful, producing rapid and reliable growth, which is the catnip that gets institutional investors piling in.

Dutch Bros. (BROS) has been around for 30 years and focuses on hand-crafted, high-quality cold and hot (82% of drinks served cold) beverages; espresso-based drinks are the core, but there’s also milkshakes, coffees, teas, sodas and an energy drink (its most popular offering).

There’s more to it than that: Dutch Bros. puts a big emphasis on culture, with runners meeting drivers before they hit the drive-through window to personalize orders or explain the menu, then take orders via tablets.

And the firm reportedly hasn’t expanded as quickly as it could have in the past, opening only company-operated stores since 2017 and promoting from within to keep the fun, hard-working culture intact.

Still, that’s not to say that growth hasn’t been massive — total locations were 503 as of September (the new prototypes are around 900 square feet), up from 441 at year-end 2020 and 370 at year-end 2019.

Store economics are solid (full payback within two to three years), and the firm is opening new locations like mad, with 33 new ones in Q3 and at least 30 more coming in Q4. Long term, Dutch thinks it can have 4,000 locations in all!

Throw in solid same-store sales growth (7% in Q3) and the numbers are excellent—Q3 saw revenues up 50% and earnings of seven cents per share, up 150%, with a lot more of that expected in the years ahead.

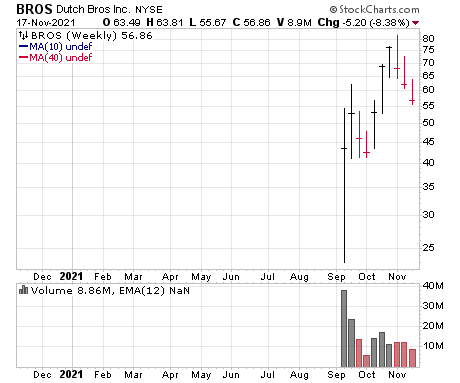

The valuation is rich ($9 billion market cap) and the stock is new, but we’re keeping an eye on BROS — this is the type of new, easy-to-understand growth story that could have a good run as the stock becomes better known.