AT&T (T) is the world’s largest telecom company by revenue; the firm has about 100 million US consumers, 3 million business customers, 17 million TV customers, and 15 million fiber broadband customers, notes Prakash Kolli, income specialist and editor of Dividend Power.

Before the acquisition of WarnerMedia and the impending reorganization, AT&T was a dividend growth stock. The company had previously raised the dividend for 36 years in a row, making the stock a Dividend Aristocrat.

However, the dividend has been held constant for the past eight quarters breaking the streak of increases. In addition, the transaction to acquire WarnerMedia was completed in June 2018, so the dividend freeze coincides with the acquisition.

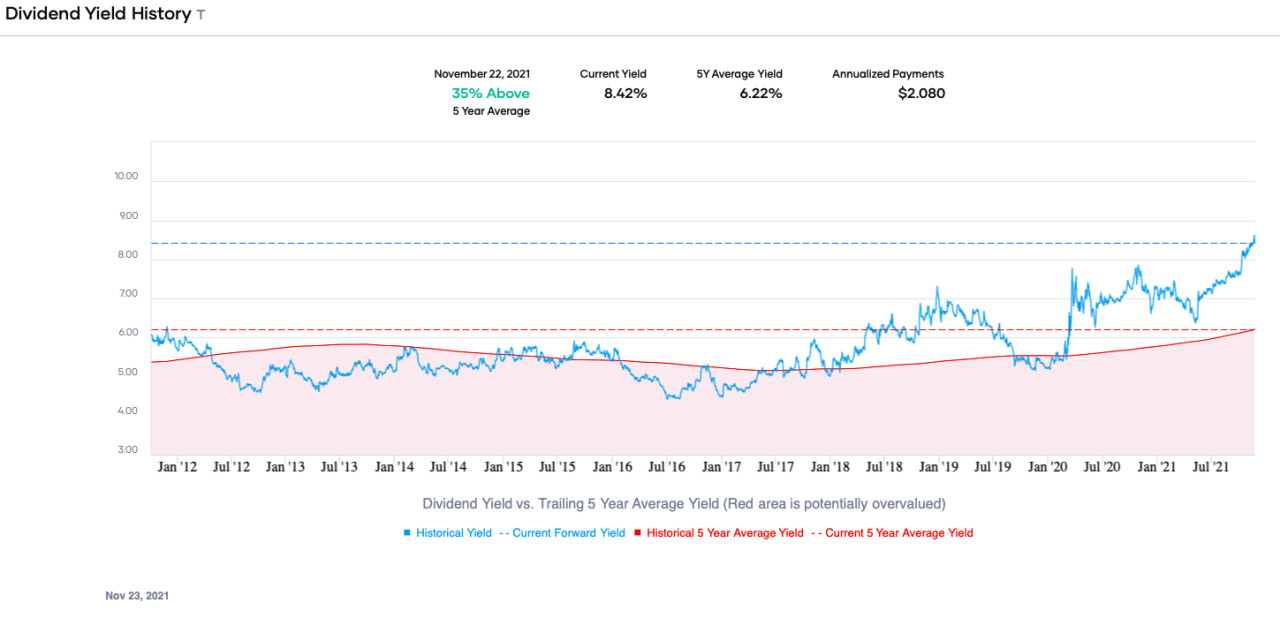

AT&T’s annual dividend rate is currently $2.08 per share. The stock price has declined since May 2021, and simultaneously the dividend yield has risen to roughly 8.6%. This yield seems attractive, but AT&T’s dividend will be cut due to the reorganization.

Based on free cash flow, the dividend cut will reduce the dividend rate to about 40% to 43% of the expected free cash flow (FCF) of $20 billion. This cut means that the dividend will consume about $8 to $8.6 billion of free cash flow. It is important to know that the current dividend requires about $15 billion in FCF.

Therefore, we estimate that the dividend will be roughly half of the current rate at $1.04 per share, resulting in a dividend yield of about 4.3% at the current stock price. In relative terms, the dividend is a good one but much lower than before the divestment.

AT&T’s dividend safety will be much improved in the context of free cash flow. The current payout ratio is approximately 62%, and the future payout ratio is unknown. However, the payout ratio will likely be lower than before the reorganization.

Since the merger with Time Warner, AT&T has focused on reducing debt. The dividend has been held constant in part to reduce debt. Furthermore, AT&T will reduce net debt by ~$43 billion by spinning off WarnerMedia. Net debt at the end of Q3 2021 was $188,201 billion.

AT&T will still be indebted after the spinoff, but debt should not place the reduced dividend rate at risk. AT&T’s credit ratings are Baa2 from Moody’s, BBB from S&P Global, and BBB+ from Fitch. These are all investment-grade ratings.

AT&T’s competitive advantage is its strong brand name and scale. Almost every consumer and business in the US knows AT&T. The company is the market leader in wireless, and most large businesses are customers of AT&T. The wireless business is the largest and arguably most important one.

The main risk for AT&T is poor capital allocation. The company has repeatedly demonstrated an inability to correctly assess acquisitions resulting in value destruction for shareholders. The other significant risk to AT&T is competition. Both the wireless and fiber businesses have strong competitors with deep pockets. AT&T is an important player, but it has no distinct advantage.

From a valuation standpoint, AT&T’s stock price has been in a downtrend since May 2021. The stock is in bear market territory, down more than a third from its 52-week high of $33.88. AT&T’s stock price is $24.70 as of this writing. The stock price is below the 50-day and 200-day moving averages.

From a price-to-earnings (P/E) ratio multiple, AT&T is undervalued. The forward P/E ratio is 7.7X. AT&T has historically traded at a P/E ratio of about 12X in the past decade. If we discount the P/E to 10X for a fair value estimate, we get $33 per share based on consensus earnings of $3.38 per share.

AT&T is a company in transition. However, once the transformation is complete, AT&T will be focusing on telecommunications, namely wireless and fiber. These are mature businesses, but AT&T should grow revenue and earnings in the low-to-mid single-digit range.

It is possible that after the spinoff of WarnerMedia, AT&T’s dividend will grow again since net debt will be lower, and the dividend safety metrics will be much improved. In addition, the stock is undervalued. However, investors should be aware of the risks before buying AT&T.