With continued tax-loss selling and forced selling in several funds that are closing doors, small cap biotechs are seeing dramatic, widespread drops in their stock prices, asserts John McCamant, editor of The Medical Technology Stock Letter — and a participant in MoneyShow's Accredited Investors Virtual Expo, Dec. 7-9. Register here for free.

We strongly believe that this soft period will eventually subside — in our view by year end — creating a liquidation sale for biotech investors. Here are 5 factors to consider.

1. Tax-Loss Selling

Tax loss selling has hit the group hard, where most diversified investors have gains in almost every other sector. The momentum driven biotechs are feeling the rotation to electric vehicles and energy stocks that are being supported by the Biden infrastructure bill.

As a result, biotechs are an afterthought right now and any loss is being used as a tax offset for a capital gain. As a reminder, there is a 30-day window to buyback a stock used for tax loss year-end planning, hence anything sold lately may stay depressed or not recover for a month or so.

2. Funds Are Closing/Returning Cash

Some large dedicated funds are turning to what are called Family Offices and they are returning funds to limited partners and that in turn leads to further selling, exacerbating the moves. In addition, we have also learned that there are some smaller funds closing doors in the current weak environment — where year-to-date losses are way more than double-digits.

At the same time, existing larger funds (e.g., Perceptive, Baker Bros, etc.) are having poor years and more likely sitting on their hands and/or supporting existing positions. Taken together there is little incentive to step in while there is a forced fire sale.

3. Too Many Companies

Whether public or privately held, there are just too many biotech companies. The vast majority are well funded thanks to the success of 2020 and early 2021, but that doesn’t mean there is enough money to soak up all the new paper.

There will be many companies trading at cash that brokers will be promoting in the current market environment. We advise sticking with those with strong and improving fundamentals.

4. A Nice M&A Surprise

The recent announcement of a takeover of Dicerna (DRNA) by Novo Nordisk (NVO) is a classic reminder of the appeal of biotechnology investments. The 80% premium is in line with most other takeovers that have occurred in 2021 (and 2020).

We expect that Big Pharma/Big Biotech will use their strong balance sheets to add pipeline assets this year, especially as corporate tax rates are going to rise next year. In addition to DRNA/Novo, Alnylam (ALNY), the mRNA leader, was also in the rumor mill lately as a target for Novartis (NVS).

5. We Will See A Year-End Rally

If there was "fear & greed" index for biotech, we believe it would be in the extreme fear mode. Also, most good news is being greeted as a trading/liquidity event, so there really is a dearth of buyers/demand. This has created a major opportunity, we believe, for any patient investor.

As has been the case, the fundamentals of the sector remain strong (e.g., pro industry veteran Bob Califf was just named by President Biden to head the FDA) and this, too, shall end.

We are always recommending our Top Picks and acknowledge the weakness in several of our coverage universe — such as Alkermes Plc (ALKS), which is involved in oncology and treatments for alcohol and opioid dependance; Precigen (PGEN), involved in gene and cell therapies; and even Celldex Therapeutics (CLDX), a developer of monoclonal and bispecific antibodies that target inflammatory diseases and cancers.

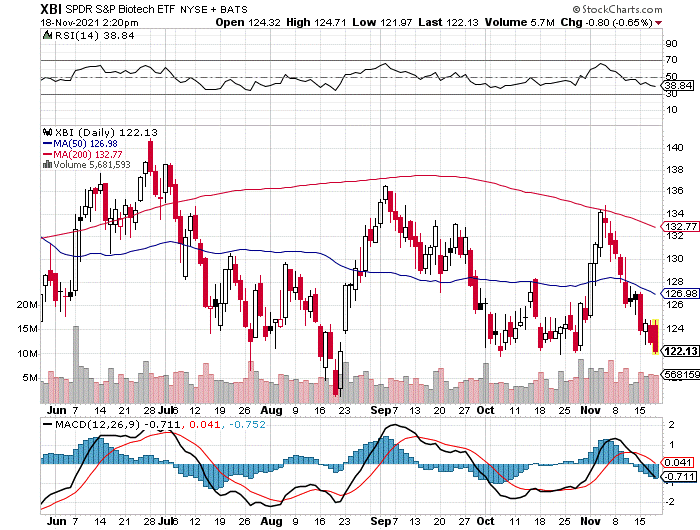

For those unsure of exactly what stocks to buy, we see support in the SPDR S&P Biotech ETF (XBI) and higher volatile Direxion Daily S&P Biotech Bull 3X Shares ETF (LABU) at ~118-120 and 48-50, respectively as the indices are nearing oversold conditions.