Have you noticed what’s going on with global electric vehicle (EV) sales lately? asks Sean Brodrick, growth stock specialist and editor of Wealth Wave.

EVs, including battery electric and plug-in hybrids, made up 7.2% of global car sales in the first half of 2021, up from 2.6% in 2019 and 4.3% in 2020, according to new data from Bloomberg New Energy Finance.

What’s more, sales are accelerating! In North America, EVs made up 3% of sales in the first half, but industry analysts say 5% is possible in the second half of the year.

If this trend holds, EV sales are projected to surpass 7 million cars globally in 2021, more than DOUBLE the 3.2 million sold in 2020. Looking forward, BloombergNEF forecasts the number of EVs on the road will increase 11 TIMES by 2030 from 2020 levels.

As you might expect, this is putting the squeeze on the energy metals needed to make those cars go. The IMF is expecting supply shortages in all sorts of materials. And cobalt is the second-worse squeeze, right after graphite.

Now, this supply-demand gap isn’t just due to EVs. The IMF says this metal demand is necessary as part of the total clean energy transition to avoid the worst effects of climate change.

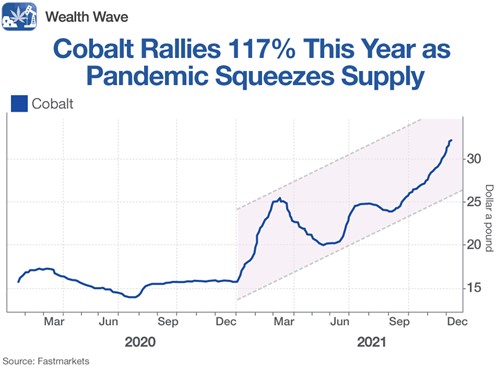

However, it does point out that a typical EV battery contains 14 kilograms of cobalt, along with 18 pounds of lithium, 35 kilos of nickel and 20 kilos of manganese ... so, EVs are definly part of the squeeze. Speaking of a squeeze, I bet you can guess what’s happening to cobalt prices (hint: they’re booming!)

Yep, cobalt prices have rallied 117% this year. What do you think is going to happen going forward? I’d say prices are likely to go vroom-vroom! Cobalt is usually produced as a byproduct of other metals. You can look a long time to find a cobalt producer listed on a main U.S. exchange ... or you could look into an exchange-traded fund.

One way to get exposure in the space is the VanEck Vectors Rare Earth/Strategic Metals ETF (REMX).

It has a net expense ratio of 0.63%. Its biggest holding is Zhejiang Huayou Cobalt, and this fund has a lot of exposure to rare earth metals, which are in a supply/demand squeeze of their own.

Another way to possibly play this trend is with the VanEck Green Metals ETF (GMET). This is a new fund just listed on the NYSE-AMEX on Nov. 11. It has a net expense ratio of 0.59%, and it owns more cobalt producers than REMX.

Its holdings include the previously mentioned Zhejiang Huayou Cobalt, as well as Glencore (GLNCY), Norilsk Nickel (NILSY) and other miners that produce cobalt, along with other metals.

To sum it up, GMET gives you more cobalt exposure, while REMX is a more established fund with more volume. I recommend using whichever one fits your investing profile, but like always, remember to do your own due diligence before buying anything. Cobalt’s continued climb could very well be in the cards, and the opportunity for investors is calling.