As we head into the holiday season, there’s no shortage of economic news to consider — consumer inflation, producer inflation, and a freshly concluded Fed meeting, notes Peter Krauth, commodities specialist and editor of Gold Resource Investor.

Let’s start with inflation. The latest U.S. inflation reading is at 6.8% for the last 12 months. That is big. In fact, it’s the highest reading since 1982, or 39 years! November made for the 5th straight month that inflation was above 5%. Food prices are running at 6.1%, energy is at 33.3%, new vehicles are up 11.1%, used cars and truck are up 31.4%, and on and on.

The other big number to note is the Producer Price Index (PPI). Remember, the PPI is a price index that tracks changes in the cost to produce the things that we as consumers buy. So it’s not the final product, but the raw materials and other inputs to make those products.

The latest PPI reading was 9.6%, the highest ever since the readings have been tracked, going back to November 2010. And if producers are paying nearly 10% more, how long do you think it will be before those costs get passed on?

According to the Food and Agriculture Organization of the United Nations (FAO), food prices are up dramatically worldwide. The chart on the right shows individual year food prices since 2018. As you can see, 2020 and 2021 have seen huge increases. In the last 12 months global food prices are up an astounding 27.3%

And in Canada, recent forecasts suggest consumers will endure 7% higher prices for food in 2022. That translates to $1,000 per average household, and is a big number for many to pay.

The point is, transitory is gone, and high inflation is here to stay. What’s the Fed doing about it? Well, at this week’s meeting, they decided to speed up the tapering of their bond purchase program.

It was announced in November that they would speed the pace of tapering from $15 billion per month to $30 billion. At this rate they will end bond purchases by March 2022, rather than mid-2022. But that’s not really tightening. It’s actually lessening the ongoing “easing”. It’s still stimulating, but at a slower pace. Tightening will only happen once they start to raise rates.

I think that once the market realizes the Fed will only be able to raise rates very slowly, the U.S. dollar will start to weaken once again. After six months straight of above 5% inflation, I expect consumers to start accepting that as the new normal. And that will set the stage for gold to enter a new phase of rising prices.

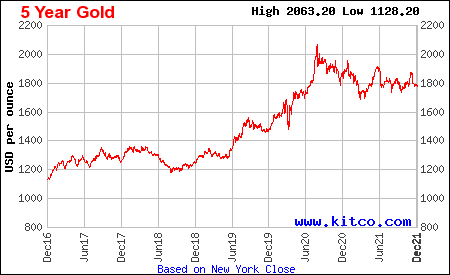

Through the past year gold has struggled somewhat as it continues to digest the strong gains of the past two years. Many wonder, has gold lost its golden touch? But remember, gold was $1,200 as recently as late 2018. It’s now almost 50% higher! That looks pretty good to me.

I don’t see an asset that’s struggling. Instead, I see an asset that’s consolidating, and building strength before starting a new leg up. I think that once the market sees the Fed is unable to raise rates meaningfully enough to actually dent inflation, gold will resume its bull market action. And given recent events, that time may not be far off.

So as we get closer to calling 2021 “last year”, look for gold to surprise on the upside. It’s coming. The only question is whether that time is sooner or later. Gold investors’ patience will be rewarded. And I think 2022 will bring that turning point.

Among our portfolio holds, we own ETFs — Sprott Physical Gold Trust (PHYS) offers basic exposure to the gold price along with low risk and a low premium to gold prices.

Sprott Gold Miners ETF (SGDM) offers excellent, instant diversification, exposure to a high potential sector and low overall sector risk. It should run higher next year, especially if the Fed starts to raise rates. Meanwhile, gold miners remain very undervalued right now.

Sprott Junior Gold Miners ETF (SGDJ) offers exposure to the higher potential junior gold sub-sector. and mid-tier The ETF has exposure to mid-tier company which mostly remain very undervalued. The ETF also pays an attractive 2.21% dividend.