Since the start of the pandemic, lumber has seen two booms. The first came in early 2020 as the work-from-home trend sparked a renovation wave across the country, recalls Sean Brodrick, editor of Wealth Wave.

That bubble burst in May of last year and bottomed in August. But lumber ain’t done … not even close. We’re in the middle of another rally right now for very different reasons … and it could be very profitable for investors.

When I say things are different this time, I mean it. The first bubble did not have a new home component. This one is fueled by a housing boom ... but it’s also more of a supply squeeze.

The worst wildfire season in memory has torched the U.S. Pacific Northwest and parts of Canada that are the biggest suppliers of American hardwoods. At the same time, supply chain snafus are delaying shipment of wood from other countries, including Canada.

And if you’ve visited a home supply store for 2x4’s in the last couple of years, you know what I mean. This is reflected in the markets. From a bottom of $515 last August, even with wild swings along the way, near-term lumber futures recently traded at $1,216, more than double!

Many analysts expect lumber prices to continue climbing as the construction boom continues and as homeowners decide to upgrade their current homes rather than move amid tight inventory … a so-called remodeling boom.

Investors seeking to play this potential rise in lumber prices can buy lumber stocks or purchase an exchange-traded fund like the iShares Global Timber & Forestry ETF (WOOD). The ETF gives investors broad exposure to companies that produce forest products, agricultural products and paper and packaging products.

The fund aims to track the S&P Global Timber & Forestry Index. It managed more than $300 million of net assets as of late 2021.This ETF currently tracks 25 stocks. The five largest holdings are: West Fraser Timber (WFG), Weyerhaeuser (WY), Svenska Cellulosa (SVCBF), Rayonier (RYN) and PotlatchDeltic (PCH).

Rayonier, Weyerhaeuser and PotlatchDeltic are real estate investment trusts (REITs) that generate revenue by owning timberland. They harvest and sell the lumber to either mills they own themselves — or those operated by third parties. (Sweden’s Svenska Cellulosa is Europe's largest private forest owner.)

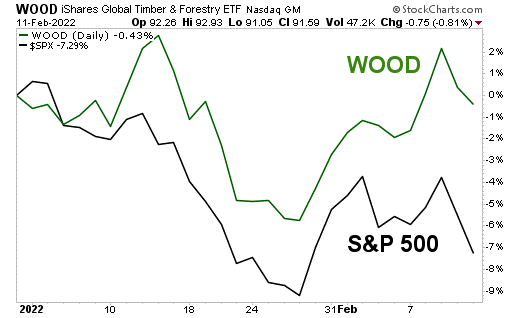

WOOD has done well so far this year despite a broad market sell-off. This is in part thanks to the market rotation from growth to value. Here’s a performance chart comparing WOOD and the S&P 500 so far this year:

You can see that WOOD is positive for the year — a tribute to the value of its component stocks — while the S&P 500 was recently down 7.3%. The expense ratio for WOOD, at 0.46%, is reasonable. But average volume is relatively low at 26,731. So, if you decide to buy it, I would recommend purchasing it in small bites, so you don’t get burned.