The broad markets have registered significant, but constrained, volatility thus far in 2022, with the S&P 500 down about 8% from last year’s highs as of this writing, and the NASDAQ 100 down about 14%, points out Monty Guild, money manager and editor of Guild Investment Management's Global Market Commentary.

Those figures mask a different, deeper, and more systemically important reality that mark the current situation of markets as somewhat different from a garden-variety correction.

A whole slate of the highest flyers of the pandemic era have almost come back to earth following their dramatic round trip to the stratosphere of valuations. They are a motley group of mostly tech and tech-adjacent stocks — although a few others made the list, including some real-estate, legacy media, and biotech companies.

Some are “meme stonks” bought by Reddit punters on a wing and a prayer. Others are reputable, well-managed growth companies with excellent growth prospects that just got caught in the vortex and saw their valuations climb to untenable levels. Perhaps they could all be bundled in a new “Icarus” ETF.

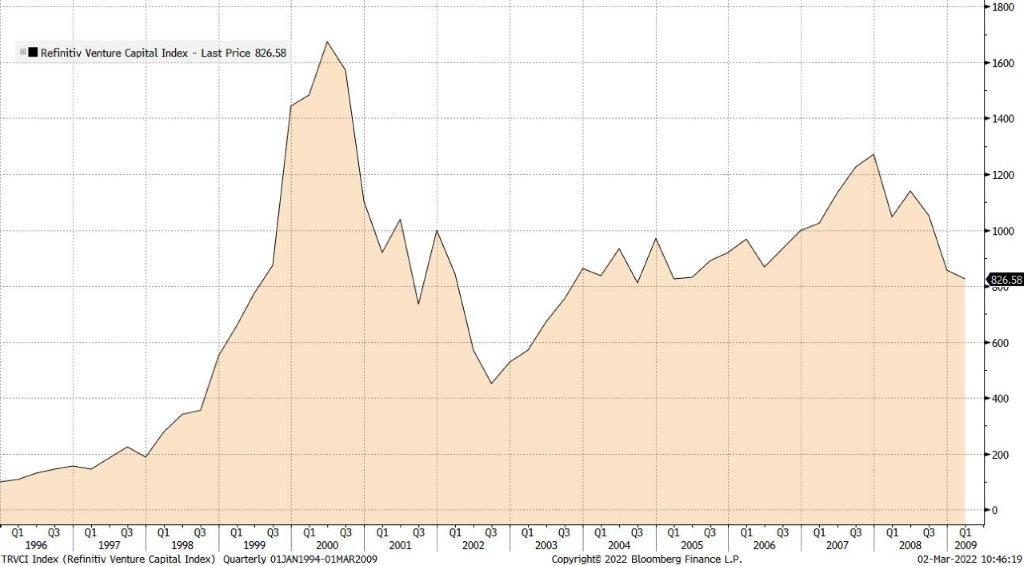

Joking aside, the action in public markets for this type of merchandise reflects something that is also occurring under the surface in the world of venture capital. Let us turn our minds back to another era of endless liquidity and futurist hyper-optimism: the Dot Com boom and subsequent collapse. Here is how venture capital performed during that era:

Source: Bloomberg LLP

The spike and the collapse were dramatic, over a period of two years erasing some 75% of the value of the index.

How did this index fare in coming years? Here is the next race to a peak, and the beginning of what will, in our view, likely be an even sharper correction:

Source: Bloomberg LLP

Coming out of the Great Financial Crisis, venture capital was cautious, but ramped up as systemic financial liquidity grew during the initial rounds of QE. Then it exploded with the arrival of pandemic stimulus in 2020 and 2021. The waterfall that began this year is a sign of a coming sea-change.

The current macro environment is altogether different from what prevailed from 2000 to 2002. The starting-point for interest rates is at the lower bound; central bank balance sheets and corporate leverage are at heights that were then unthinkable; inflation is at multi-decade highs; geopolitical tensions among global superpowers are elevated; and the Federal Reserve seems set on a second policy mistake — after keeping the foot on the pedal too long, suddenly slamming on the brakes.

For all these reasons, we anticipate that the waterfall on the right of the above venture capital chart is going to continue downwards, at a pace that will greatly exceed what was seen from 2000 to 2002. That cascade, driven by receding liquidity, is going to instill a new discipline in both private and public firms that had been buoyed by excessively exuberant valuations.

A generation of younger entrepreneurs and investors is thus about to experience a radically different environment from that in which they cut their teeth: one shaped profoundly by an abundance of artificially cheap money courtesy of post-2009 and post-2020 monetary policy.

Investment metrics from an earlier and more sober era will begin to gain traction — and both public investors and venture capitalists will begin digging deeper and not just basking in the glow of an inspiring theme and a sky-high TAM (total addressable market).

By no means are we downplaying the significance of some of the public companies that find themselves down 70%, 80%, or even 90% from their highs. In the wreckage there are many worthy and valuable companies which investors will now, or relatively soon, be able to start accumulating at actually reasonable prices.

There are also investors who have owned these solid companies through the madness, watching them rise and fall, but confident in their long-term prospects and happy with their entry price.

Investment implications: Price matters, and even after the dramatic declines experienced by pandemic tech leaders, the drastic decline in venture capital valuations suggests that there is still more pain to come.

However, among the hardest hit, there are gems — companies situated well in the business and commerce digitization wave that the pandemic so sharply accelerated. Many crypto and DeFi projects fall under the same rubric. To find these gems, however, will require an older and more disciplined kind of analysis than what worked during the era of QE, ZIRP, infinite liquidity and free money.

Subscribe to Guild Investment Management's Global Market Commentary here…