Some folks call it “reshoring” or “deglobalization.” You may also have heard the term “friend-shoring,” where companies move to countries with strong relationships with the US, observes Brett Owens, editor of Contrarian Outlook.

Whatever you call it, the tariff wars of the late 2010s kicked it off, then COVID-19, with its supply chain snarls and PPE scavenger hunts, accelerated it.

Then came the war in Ukraine, which whacked supply chains again while jacking up shipping costs. Meantime, companies that still haven’t gotten the message and have stood pat in China are getting twitchy as Xi Jinping gazes across the Taiwan Strait.

So given all that, what the heck are we going to do? Simple: we’ll zero in on manufacturing stocks that focus on developed markets (especially the US) and/or are “onshoring” into those places.

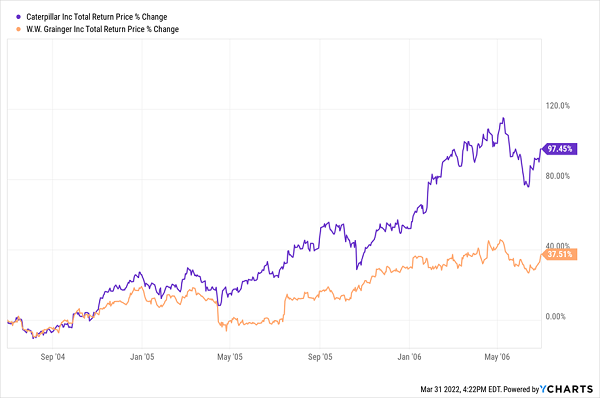

Better still, manufacturing stocks tend to do well when rates rise. Let’s look at 2004 to 2006, when rates spiked from 1% to 5.25% in just two years. That’s a landslide, and that cycle peaked far above where rates are expected to go today.

No matter; the two stocks we’ll look at below — heavy-equipment maker Caterpillar (CAT) and parts-distributor W.W. Grainger (GWW), soared. Both have a big presence in America or “friendly” countries, and both have fast-growing dividends.

Top Manufacturers Rolled Through the Last Rate Surge

Caterpillar is the quintessential American success story: the Deerfield, Illinois–based heavy-equipment maker is nearing its 100th anniversary, having been founded back in 1925.

Let’s take a second here to tip our hat to co-founder Ben Holt’s “Caterpillar,” which he invented by replacing the wheels on his tractor design with treads in 1904, so the machines could traverse muddy fields

Caterpillar’s dividend is almost as old as the company itself: the payout started rolling out to investors in 1933 (in the depths of the Great Depression, no less), and CAT has hiked it every year for the last 28, earning itself a spot on the Dividend Aristocrats list.

The company has been expanding in the US over the last decade, opening new plants in Georgia, for example, and expanding its operation in West Fargo, North Dakota.

We’ve got plenty of reasons to expect CAT's dividend to get stronger, thanks to the 27% jump in trailing-12-month free cash flow (FCF) the company has booked in the last three years. Plus it boasts a very safe payout ratio, with 49% of FCF headed out the door as dividends. That potential dividend growth means you can expect the 2% yield you get on a buy made today to start arcing higher before long.

Grainger is another built-to-last American firm, but unlike CAT, almost no one talks about the humble parts distributor. But it should be on every dividend investor’s radar.

The company was founded in 1927, only a couple of years after CAT, so it, too, has survived booms, busts, inflation, deflation, wars, you name it. Also like Caterpillar, it has been paying (and hiking) dividends for decades: Grainger’s payout has climbed annually for 50 straight years.

The company distributes all manner of parts manufacturers need: fasteners, plumbing pieces, motors and lighting among them. It deals with 5,000+ suppliers and boasts some 4.5 million customers.

Grainger’s operations are mainly in North America, Japan and the UK, which puts it in an excellent position to deal with supply chain snarls. In fact, the folks at Grainger are probably wondering what all the fuss is about! In the fourth quarter, adjusted earnings popped 49% from a year ago on a 14% jump in sales.

Also like Caterpillar, we can expect this run to continue: the payout occupies a safe 52% of free cash flow and only 34% of earnings. Resilient demand for goods across the globe, plus a continued restoration of supply chains, will support Grainger’s cash-flow growth and help grow its payout faster.

On that note, Grainger typically declares dividend hikes at the end of April, and its last one came in at a nice 6% increase. That makes now a good time to buy, before news of the next (likely substantial) hike breaks — and draws more buyers to the stock.