Health insurer Anthem Inc. (ANTM) is one of the best in the business, providing medical benefits to roughly 45 million medical members, notes Jim Woods, editor of Bullseye Stock Trader.

The company offers employer, individual and government-sponsored coverage plans. Anthem differs from its peers in its unique position as the largest single provider of Blue Cross Blue Shield branded coverage, operating as the licensee for the Blue Cross Blue Shield Association in 14 states.

Through acquisitions, such as the Amerigroup deal in 2012 and MMM Holdings in 2021, Anthem’s reach expands beyond those states through government-sponsored programs, such as Medicaid, too.

Anthem’s size is what has helped the company’s earnings per share grow rapidly, and over the past several quarters and several years, its EPS growth has vaulted ANTM into the top 5% of all companies on an EPS growth basis.

That growth, along with the defensive sector appeal of health insurers during a time of market pressure, has resulted in the shares gaining some 18.6% over the past three months, and some 37.1% over the past 52 weeks. The latter metric also puts ANTM shares in the top 5% in terms of relative price strength.

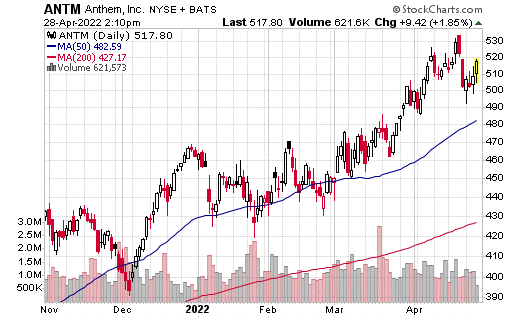

Technically speaking, ANTM shares are just slightly below their recent 52-week highs after a very nice run higher of late. I suspect that at the stock’s current levels, we can get into it as it’s building its next base.

This is also right before it makes its next big move higher. And if price history is any guide, the stock has done precisely that in late December, then again in February and once again in mid-March.

Given the confluence of bullseyes here in ANTM, I recommend you buying the stock at market with a protective stop set at $456. Note, on May 18 the company’s board will vote to adopt a new proposed name, Elevance Health.