When interest rates go up, Wall Street sells fixed income. The whole dynamic makes sense in a way. Investors will reason that U.S. Treasuries are risk-free, observes Rida Morwa, income specialist and editor of High Dividend Opportunities.

If the U.S. government ever defaults on Treasuries, you don't have to worry about your portfolio because pretty much everything is worthless. Picking bonds becomes moot if the full faith and credit of the U.S. government become as meaningful as the full faith and credit of my dog.

So, investors reason that bonds should trade at a "spread" to U.S. Treasuries, and that spread reflects the risk. If 10-year Treasuries are 1% and a 10-year corporate bond is 3%, the 2% extra return reflects the extra risk for investing in a corporation that might default as opposed to taking the 1% guaranteed return.

So, if the 10-year Treasury goes to 3%, then the same corporate bond should be priced to yield around 5% because investors will still want that extra 2% to compensate for the risk. To yield more, bond prices have to come down. Reality is a lot messier, but you can see the logic.

On the other hand, PIMCO Dynamic Income Opportunities Fund (PDO) is yielding 9% from its regular dividend and last year paid a large special dividend. Investors can expect to receive an 9% yield and maybe even more.

Are you seriously going to sell something yielding over 8% with an upside to buy a U.S. Treasury yielding 3%? I wouldn't. The higher the yield is, the less it makes sense to sell in a rising rate environment.

In the short term, the market doesn't differentiate. Rates are rising, Wall Street sells all fixed income. So, when rates are rising, I love to buy PIMCO. PIMCO Corporate & Income Opportunity Fund (PTY) has been my favorite go-to for many years. PDO is a younger fund, it doesn't have the track record that PTY has. However, it has the same managers and a very similar investment balance.

PDO invests in mortgages, commercial mortgages, high yield corporate credit, and non-USD bonds among other investments. PIMCO uses its size and superior research abilities to take advantage of "special" situations that cause the price of bonds to be much lower than the value of the assets supporting the bonds.

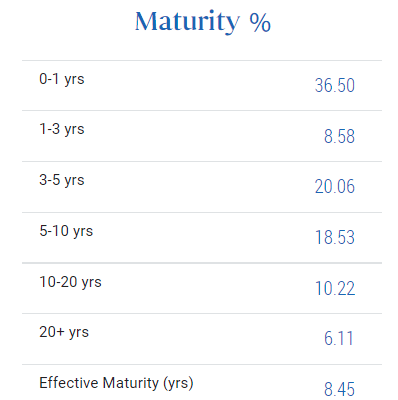

You will often find PIMCO buying where others fear to tread. For example, when others were dumping mortgages during the housing meltdown, PIMCO was a buyer. Buying up mortgages for very cheap prices from distressed sellers. PDO has about 34% of its portfolio maturing within the next year. Meaning that it will be able to actively reinvest at higher interest rates.

This will increase PDO's interest income and support its generous dividend. Unlike its sister funds, PDO is trading at a discount to NAV. This is likely due to its much shorter track record having IPO'd in 2021. Investors can enjoy a higher yield, while also seeing the price rise as book value recovers and the discount to NAV becomes a premium.

When PIMCO funds are on sale, buy them.