For my money, the most appealing player in the electric vehicle market is India-based car maker Tata Motors (TTM), asserts Jim Pearce, an industry-leading growth stock expert and editor of Investing Daily's Personal Finance.

Tata controls roughly 80% of the EV market in the world’s second-most populous country with a middle-class population that is projected to expand at an 8.5% annual growth rate over the remainder of this decade.

Tata has embarked on an aggressive strategy to increase its market share in India by diversifying its product line to appeal to regional preferences, expanding its geographic footprint to include more than 100 cities in India by the end of this year.

The company is also building out a complete ecosystem of Tata-branded EV sales, service, and charging stations throughout the country.

Tata delivered a significant tangible result on May 30 when the company announced that it signed a memorandum of understanding to purchase a Ford Motor (F) auto plant to expand its EV production capacity.

Tata said that it “expects the facility to have a production capacity of 300,000 units each year” after it has upgraded the facility to its specifications, and “the capacity can be increased to more than 400,000 units” if and when that becomes necessary.

To put those numbers in perspective, Tata sold 3,454 EVs in India during the month of May. That is its most EV unit sales ever for a single month and equates to a 626% increase on a year-over-year basis.

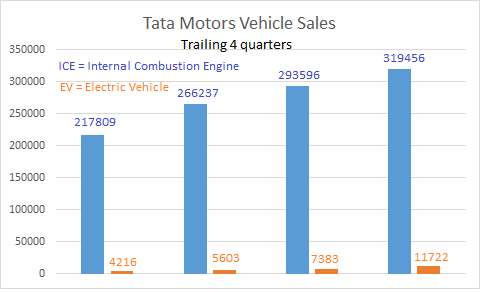

On an annualized basis, that works outs to roughly 40,000 vehicles or 10% of the future capacity of the Ford plant that Tata will be taking over. During the most recent quarter, Tata’s EV unit sales were less than 4% of ICE (internal combustion engine) passenger vehicle volume so there is a lot of room for growth.

Perhaps more relevant is the month-over-month EV sales growth rate of 48% compared to April. Bear in mind that those results were racked up while the rest of the world was reeling from rapidly rising inflation, higher interest rates, an escalating war in Ukraine, and costly global supply chain bottlenecks. However, none of those issues has as big an impact on Tata’s domestic auto sales as they do on most of its competitors.

Therein lays the beauty of Tata’s EV sales strategy. Conceivably, it could become one of the biggest EV automobile manufacturers in the world without ever having to compete outside its national borders, within which it holds a substantial home field advantage.

The addition of the Ford manufacturing facility ensures that Tata will be able to keep up with surging EV demand while it builds out the remainder of its product delivery infrastructure. Those are the types of tangible results that I’ve been waiting to see. When it comes to the EV market, I think Tata offers the most long-term upside potential.