Bear markets are the perfect time to buy discounted dividend payers because their depressed stock prices and higher yields make way for juicy passive income and significant capital upsides when the markets recover, asserts Rida Morwa, editor of High Dividend Opportunities.

Discounted preferred securities provide dual benefits of bonds and equities during fearful times. They fill your pockets with predictable income while offering room for the capital upside.

Successful investors like Warren Buffett have repeatedly taken advantage of discounted preferred units of the most impacted companies during recessions.

Virtus InfraCap U.S. Preferred Stock ETF (PFFA) is an actively managed fund with a primary emphasis on current income from a diversified portfolio of preferred securities. PFFA’s top positions include some of our favorite names such as Algonquin Power and Utilities Units (AQNU) and RLJ Lodging Trust Preferred A (RLJ-A).

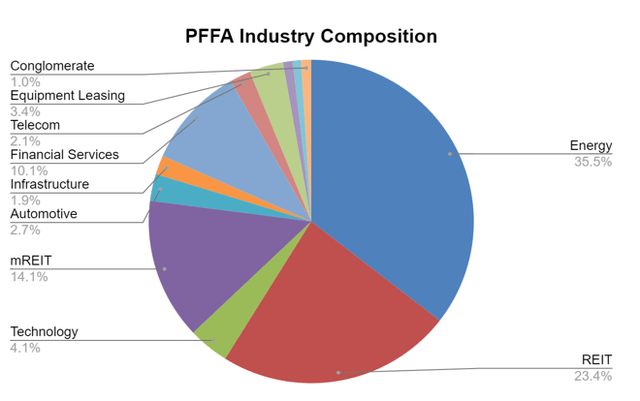

The ETF is well-diversified into over 170 preferred securities to provide a cushion against any shock of a distribution cut from individual companies. Moreover, PFFA is more oriented toward energy (mainly midstream and utility), and REITs have historically proven to be recession-resistant sectors.

PFFA has sustained growing distributions despite fluctuating stock prices since the pandemic-induced reduction in early 2020. Its current $0.1625/share monthly payment calculates to a 9.2% annualized yield. Notably, the ETF earns 100% of its distributions through dividends paid by its constituent securities.

The ETF invests in preferred securities of several MLPs but issues a form 1099 to keep your tax filing straightforward. Moreover, PFFA offers much higher liquidity for investors to quickly build a sizable position compared to directly taking a stake in its constituent securities. PFFA is an essential asset for an income investor, and this bear market just gave an opportunity to lock in 9.2% yields from this discounted ETF.