With large U.S. banks performing well in the Federal Reserve stress tests, we are optimistic about their ability to return capital to shareholders during the economic roller coaster, observes Rida Morwa, editor of High Dividend Opportunities.

The results show that all assessed banks are well-capitalized and could weather a severe economic downturn. The scenario that the Fed had devised for this year's tests is reportedly worse than any recession since World War II (including the one following the 2008 financial crisis).

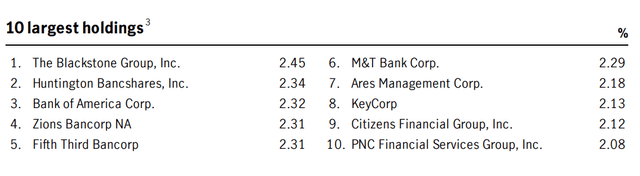

John Hancock Financial Opportunities Fund (BTO) is a closed-end fund (CEF) that aims to invest at least 80% of assets in equity securities of U.S. and foreign financial services companies. BTO's most significant positions are some of the leading banks in the country, with 7 out of the top 10 names part of the Fed's test.

BTO is diversified across 173 companies, with a modest 17% leverage employed to boost shareholder returns. BTO has achieved growing NAV and paid out increasing distributions in the past ten years. For income investors, this is like winning the CEF lottery.

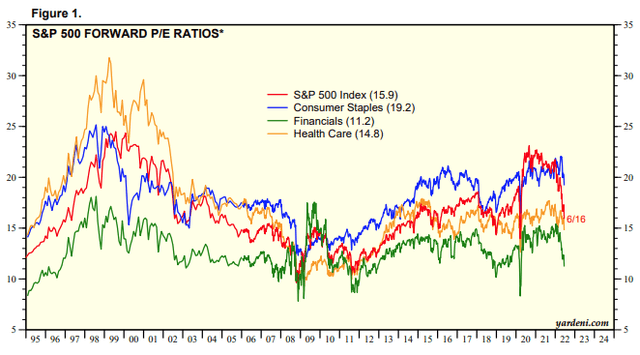

Financials are officially the cheapest S&P sector, trading below their 10-year average. Amidst this cheap valuation, we find safety in high yields from BTO, which just got tastier with an 18% increase in its most recent payment.

The CEF's current annualized yield stands at 7.3%. BTO's portfolio is 92% U.S. institutions and 1.6% Canadian, and 1% French (where banking regulations are stricter than in the U.S.).

To sum up, banks are suitable investments when we experience rising rates. Moreover, leading U.S. banks are well-positioned to weather a tough recession, so it is time to take advantage of the cheap sector valuation and lock in high yields.