As a result of the wave of selling caused by war in Ukraine and the continued effects of supply chain disruptions, some investors are turning to dividend-paying stocks as sources of solace in an increasingly turbulent and unstable world, notes Jim Woods, editor of Successful Investing.

Studies by Ned Davis Research, among others, have lent empirical support to this strategy, as scholars have found that both domestic and international companies whose dividends increased year-over-year for the past 20 years outperformed companies whose dividends either remained flat or decreased. The task of finding good dividend-paying stocks is easier said than done.

After all, discovering the companies that have such a history is problematic. It involves predicting which ones are best suited to endure the unpredictable shocks that the world generates without cutting or eliminating the dividend payouts.

However, there are more than a few dividend-paying-related exchange-traded funds (ETFs) that aim to demystify this process. One of these is the iShares Select Dividend ETF (DVY).

This ETF tracks a dividend-weighted index of American companies, including real estate investment trusts (REITs), that is slanted toward small-cap companies that pay dividends, but the stocks in the portfolio are selected after a rigorous selection process. The fund’s managers draw on five-year dividend growth patterns, payout ratio and payment history as criteria for selection in the portfolio.

The top holdings in the portfolio are International Business Machines (IBM), Altria Group (MO), Valero Energy Corp. (VLO), Philip Morris International (PM), Gilead Sciences (GILD), ONEOK, Inc. (OKE), Exxon Mobil Corp. (XOM) and Verizon Communications (VZ).

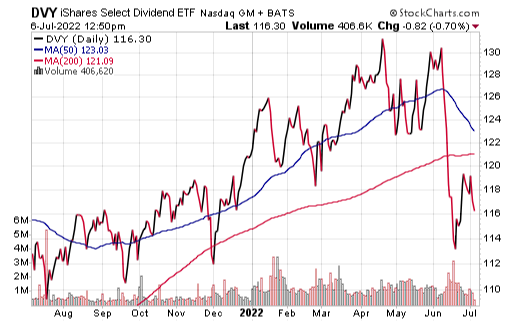

Chart courtesy of www.stockcharts.com

The fund has amassed $21.35 billion in assets under management and has an expense ratio of 0.39%. As of July 6, DVY has been down 8.82% over the past month and 7.57% for the past three months. It is has slid 3.13% year to date.

While DVY provides investors with access to dividend-paying stocks, this kind of ETF may not be appropriate for all portfolios. Thus, interested investors always should conduct their due diligence and decide whether the fund is suitable for their investing goals.