All this negativity in markets can drive a man to drink — and that is what we are going to position ourselves to do with our newest buy recommendation, Constellation Brands (STZ), jests Jim Woods, editor of Bullseye Stock Trader.

Constellation is the largest multi-category alcohol supplier in the United States. The business is anchored by a portfolio of Mexican beer trademarks, including Corona and Modelo, for which it acquired exclusive and perpetual U.S. ownership from AB InBev.

Constellation’s wine/spirits business has recently transitioned and divested several lower-margin assets, including myriad wine brands and its Ballast Point craft beer brand.

The firm imports most products after manufacturing them abroad, before then sending them to market through independent wholesalers. It also owns 36% of Canopy Growth Corp. (CGC), which is a leading provider of medicinal and recreational cannabis products.

In its most-recent quarter, STZ reported earnings growth of 14% year over year, a very robust showing, particularly considering the challenging economic environment. That solid growth, along with growth over the past several years, has put STZ in the top 15% of all companies on an EPS growth basis.

As for share price performance, STZ has seen gains of 9.25% over the past year -- a move that puts it in the top 8% of all public companies in terms of relative price strength.

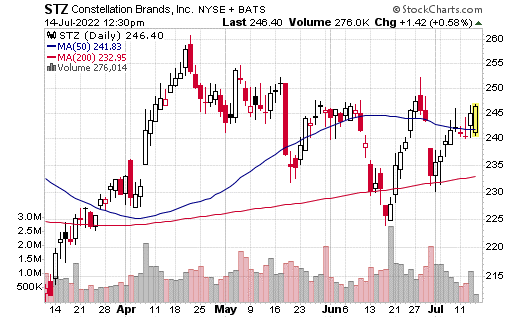

Technically speaking, I like STZ here as it just broke back above its 50-day moving average after shedding some value during that early June swoon that caught all the bulls napping.

Yet, after breaking back above the 200-day average, and then this week moving past that 50-day average, I think the stage is set for a run up to this year’s highs just shy of $260. Buy Constellation Brands shares at market, with a protective stop loss set at $216.00.