We still believe we are seeing nothing more than a bear market rally in progress, cautions Alan Newman, market timer and editor of CrossCurrents.

Our expectation for quite some time has been that we were/are destined for one of the most severe bear markets ever and we have seen absolutely no reason to change that view.

Bear markets occur in price but they also occur in time. The Crash of '87 was a bear market in price, gouging out 22% in only one day and over 36% total but it was all over by the first few days in December, when the Dow Industrials surged on three consecutive days to banish the bear.

That was a friendly example of price and time. An unfriendly, actually savage example would be the bear market that lasted 26 years from the 1929 peak and bottoming 89% lower.

We are anything but sanguine about prospects for stocks. Our long term price target is roughly 60% lower than the October 2021 highs. Worse yet, we simply see no reason for recovery for a very long time to come.

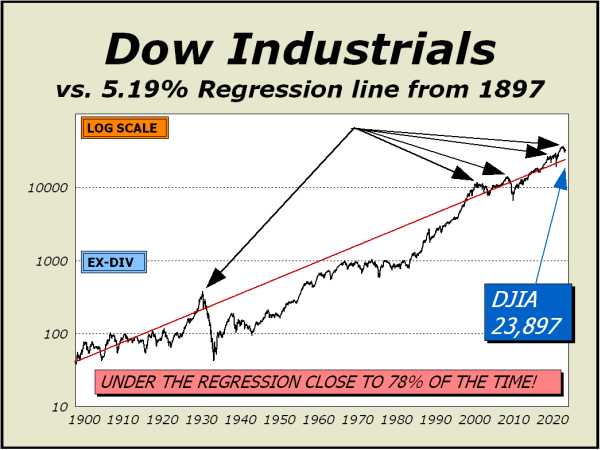

Below, we present our chart illustrates a regression line from 1897 through today. We've published this chart often over the last few years, using a 5% annual incline.

The historical average is actually a bit higher at just over 5.2% and we're using 5.19% in this example, which is what you get if you exclude everything from the beginning of the 2020 crash and subsequent mania. Why be so picky? Because we were in a mania before the 2020 crash.

Are similar circumstances even repeatable in the next hundred years? Clearly, we've been in "La La land" for quite some time and we believe we have the right to be a bit finicky, so here you go — a 5.19% incline, which takes our line to Dow 23,897, down 34.2% from the record high late last year.

A move to this line and no lower would be the absolute most positive outcome we might conjure but as history clearly shows, we trade under that line a lot more than over it.

Overall, we still see a lot more damage in our future and we expect the next phase to commence once the Dow takes out the major support zone we have been watching for more than two-and-a-half years. So, how long can the rally last? Our guess is we see a reversal late this month or at the latest, mid-September. It’s not uncommon for seasonality to turn really ugly around the August/September timeframe.