Congress recently passed the Inflation Reduction Act that includes provisions favorable to the sustainable energy trend, observes Jim Woods, exchange-traded fund expert and editor of The Deep Woods.

This only reinforces what has been clear for some time now that the trend toward sustainable energy keeps gaining power. The United States will continue regardless of geopolitical conflicts or economic uncertainty.

The Invesco MSCI Sustainable Future ETF (ERTH) — formerly Invesco Cleantech ETF (PZD) — provides an index of global companies that are involved in making the economy more environmentally conscious.

Themes present in these companies include alternative energy sources and efficiency, sustainable building projects, agriculture and water practices, as well as pollution management.

Companies to be included in this fund pass an environmental, social and governance (ESG) screen, which some investors view as important, particularly in this sector.

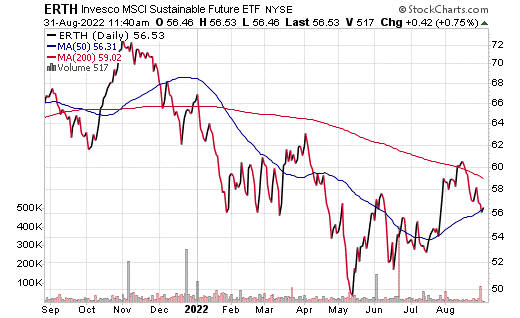

ERTH is down 16.34% in the last year, making its pullback greater than that of the S&P 500. This may make for an attractive entry point. It is also down 4.8% in the last month. Its performance over the long term looks a bit better, ringing up a 11.43% average annual increase over the last five years.

Chart courtesy of www.StockCharts.com

The ETF does offer a small dividend yield of just under 1%, which accounts for its 0.55% expense ratio with room to spare. Assets under management total $368 million, making this fund relatively small.

However, ERTH holds 265 different companies. These holdings are based in a variety of nations, most prominently the United States (34.25%) and Hong Kong (20.19%).

Top holdings include Tesla (TSLA), 5.71%; NIO Inc. ADR (NIO), 5.20%; Digital Realty Trust (DLR), 4.95%; Vestas Wind Systems (VWS), 4.87%; and Enphase Energy (ENPH), 3.96%.

For investors seeking a way to profit from the trend towards alternative energy sources, Invesco MSCI Sustainable Future ETF offers one possibility.