Nuveen Preferred & Income Securities Fund (JPS) is a closed-end fund that aims to invest at least 80% of its managed assets in preferred and other income-producing securities, explains Rida Morwa, income specialist and editor of High Dividend Opportunities.

Notably, about 86% of JPS portfolio securities maintain investment-grade ratings, indicating the higher quality of its overall composition. 65% of the fund comprises securities issued by banks, insurance companies, and capital markets.

The fund comprises 235 securities with an average coupon of 6.2%. The fund's top 10 positions are preferred securities of leading global banking names and represent about 34% of the total portfolio.

Today, the fund trades at an attractive 8% discount to NAV, making it a bargain for income investors and retirees. The fund's current $0.0435/share monthly distribution translates to a 7.2% annualized yield.

It is noteworthy that JPS has paid $16.79 in distributions since its inception in 2002. In recent years, preferred shares have struggled with low yields as low-interest rates caused preferred equity prices to be bid up, putting downward pressure on cash flow.

This has been a similar story for all fixed-income investments. While investors are trained to see higher prices as a "good" thing, for fixed-income investors, higher prices result in lower cash flow and lower future returns.

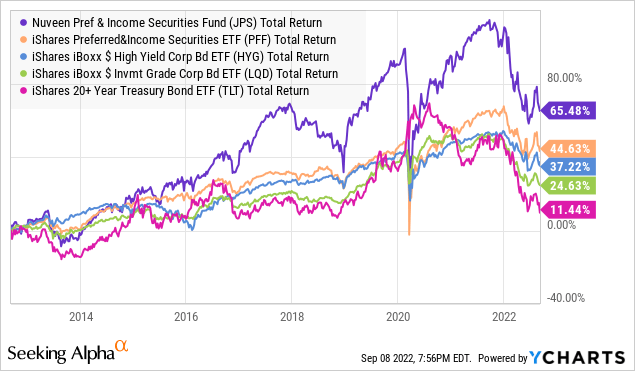

Rising interest rates are "bad" for prices, but they are great for future returns when investing in fixed income. For many years, dividends and interest from fixed-income investments have declined due to high prices and lower yields. Despite this difficult environment, JPS has outperformed the iShares preferred ETF (PPF), as well as ETFs covering other debt classes like high-yield bonds, investment-grade bonds, and treasuries.

As we look forward, yields are getting higher. Money invested today receives higher dividends from preferred shares and higher interest from debt. As JPS reinvests principal, it will be reinvested at higher yields creating a turning point from the recent downward trends.

Some are worried about a repeat of 2008, which was terrible for banks. Yet, banking firms are much better prepared to handle a brutal recession and maintain lending capabilities than in 2008.

JPS, with its portfolio built with quality preferreds from the financial services sector, has outperformed its indexes through a tough period for fixed-income. With fixed-income much more attractively priced today, the outlook for future returns is brighter.