The iShares Self-Driving EV and Tech ETF (IDRV) tracks a market-cap-selected and -weighted index of equities related to self-driving vehicles, notes Jim Woods, exchange-traded fund expert and editor of The Deep Woods.

IDRV focuses on companies that produce autonomous driving vehicles, electric vehicles, batteries for electric vehicles, or technologies related to such products.

The list of industrials covered include autonomous and electric vehicle manufacturers, autonomous driving technologies companies, electric vehicle battery producers, electric vehicle battery materials producers, and electric vehicle charging and components producers.

The fund allows for stocks from both developed and emerging economies, as well as companies of all market cap sizes. The index will be reviewed and reconstituted annually and rebalanced semi-annually.

The index is composed of equity securities of companies listed in one of 43 developed or emerging market countries that derive a certain specified percentage of their revenue from selected autonomous or electric vehicle-related industries.

The fund generally will invest at least 80% of its assets in the component securities of the index and in investments that have economic characteristics that are substantially identical to the component securities of the index. It is non-diversified.

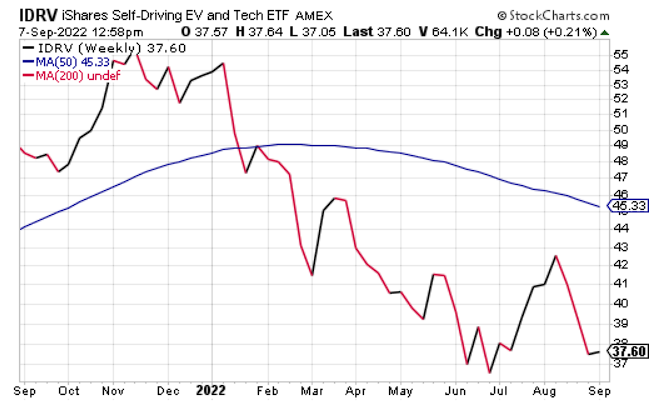

Source: www.stockcharts.com

IDRV has $444 million in assets under management and a 0.14% average spread. Its expense ratio is 0.47%, meaning it is relatively inexpensive to hold in relation to other exchange-traded funds.

With the fossil fuel industry fading in tandem with the emerging renewable energy market, this play could be a great addition to your portfolio. However, as with any opportunity, potential investors should conduct their own due diligence in deciding whether or not this fund fits their own individual investing needs and portfolio goals.