Our latest buy recommendation is Interactive Brokers Group, Inc. (IBKR) — a broker-dealer agency business and proprietary trading business that operates worldwide, notes Jim Woods, editor of the speciality advisory service, Bullseye Stock Trader.

Through its broker-dealer agency business, IBKR provides direct access to trade execution and clearing services to institutional and professional traders. The company’s electronically traded products include stocks, options, futures, foreign exchange, bonds, CFDs and funds.

IBKR has operations in the United States, Canada, the United Kingdom, Ireland, Luxembourg, Switzerland, Hungary, India, China (Hong Kong and Shanghai), Japan, Singapore and Australia.

IBKR is benefitting from the market’s volatility, and the increased trading volume that’s accompanying that volatility. So, even as the broad market has fallen this year, IBKR has grown. That’s true of its bottom line, as IBKR has seen earnings per share (EPS) growth jump 38% in its most recent quarter. Moreover, the company has seen annual EPS growth of 18% over the past three years.

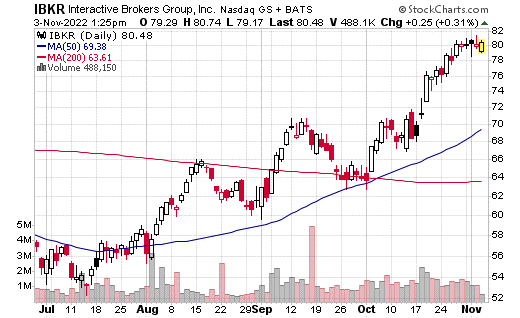

As for growth in share price, IBKR has seen its stock price surge nearly 35% over the past six months, a move that’s helped the stock vault into the top 4% of all stocks on a relative strength basis.

IBKR now trades just north of $80 per share, which, technically speaking, means it’s now slightly extended in terms of the cup-with-handle breakout pattern that began in mid-September and that’s continued after the handle formed around the $74 area.

Yet, despite the latest move higher, I suspect IBKR is going to continue to capture buyers as we approach the next earnings release, which is slated for January 17. That means taking positions now in the common shares and the call options will, I suspect, pay off nicely as we finish the year.