The Treasury bond market has experienced an historically anomalous year in 2022, suggests David Dierking, an exchange-traded fund expert and editor of TheStreet's ETF Focus.

Slowing economic growth and the threat of recession should have pushed investors towards the safety of Treasuries, but the opposite happened. Soaring inflation and a strong (albeit late) response from the Fed sent interest rates sharply higher.

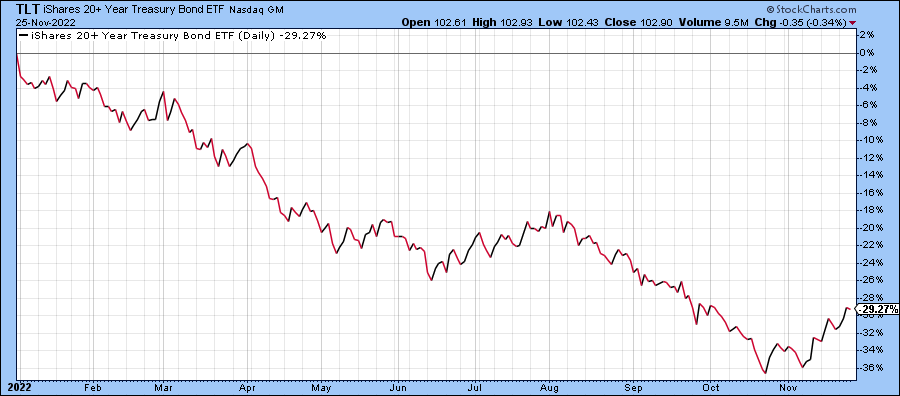

Government bonds weren’t a safe haven. They were a liability. The result has been one of the worst years for Treasuries ever, but it’s been especially painful on the long end of the curve. At its low point, the iShares 20+ Year Treasury Bond ETF (TLT) was down more than 40% from its peak. It’s still down roughly 30% year-to-date.

If you look at that chart though, you’ll see that the month of November doesn’t look like the rest of 2022. Long-term Treasuries are off to the races again.

Sure, it’s easy to say, “the economy is slowing” or “we’re getting closer to recession” as catalysts, but this belief has been in place for months and Treasuries have continued to decline. The difference now is that it finally looks like we have a consensus terminal Fed Funds rate priced into the market.

Throughout 2022, the narrative has been that of rising inflation and interest rates. Expectations for where the Fed was going to set the Fed Funds rate started out mild at the beginning of the year, but continued to climb higher and higher.

At the beginning of March, the Fed Funds futures market was essentially pricing in a 0% chance that the Fed Funds rate on March 2023 would be 2.5%. A month and a half later, the odds were nearly at 100%.

During the summer when investors were caught up in the idea that a Fed pivot was coming, Fed expectations moderated and even came down a bit. That was before Powell shot down the idea in a speech and rates were on the rise again.

But look what’s happened since mid-October. The market’s expectation for the terminal Fed Funds rate has remained roughly the same. Sure, there’s some debate about whether they stop at 4.75% or 5%, but the broader idea is that the yield curve is no longer shifting higher.

If inflation has peaked and the markets sense they know where and when the rate hikes will stop, Treasuries can begin trading on fundamentals again and not on Fed policy.

That means they can start trading on recession risk, which is exactly what I think is happening now. The terminal Fed Funds rate has been priced in and Treasuries are starting to act like a safe haven again. There are a couple of wild cards though.

- We don’t know whether inflation has peaked or not. We’ll get a better idea when the November number is released. Energy prices have been falling steadily for three weeks and that could be the driver behind another drop in the headline rate. The core rate might not be done moving higher yet. If the jobs number this week still looks strong and the core inflation rate in November creeps higher, Treasuries might have another leg lower in them.

- While the path is important, a recession might not actually show up until 12 months from now or even longer. There’s still plenty of room for equities to rally on an actual Fed pivot in the 1st half of 2023 or some other catalyst (China reopening, peace deal in Ukraine).

In my opinion, the overall trend in interest rates for 2023 is lower. Conditions could still shift in the short-term, but I think the recession narrative controls the year and the Fed will at least be thinking about a rate cut in the 2nd half of the year even if they don’t pull the trigger. That means Treasuries could be a potential high reward play in 2023.