BlackRock Science & Technology Trust II (BSTZ) — a new addition to our portfolio for 2023 — is a $1.5 billion closed-end fund (CEF) that specializes in investing in technology, notes Steve Mauzy, editor of Wyatt Research's Income Confidential.

The fund blends “next generation” technology stocks and private investments along with a tactical single-stock call-option-writing strategy. The investment category is new to our recommendation list, so it adds another degree of diversification.

A first for us, this is a a limited-term CEF. This means it comes with an expiration date. The fund is scheduled to liquid in 2031 (though the fund has the option of extending the expiration date into 2032). It’s a non-issue at this early stage, I just wanted to mention it.

The BlackRock fund holds 276 investments. Approximately 20% of the fund is allocated to private technology. That 20% has significant influence on fund performance. Five of the top 10 investments are of the private variety.

Though the entire portfolio covers many industries, the BlackRock fund is concentrated on software, semiconductors, IT services, and electronic equipment. The fund is also diversified across geography, though the highest percentage of the fund is allocated to the United States, with 59% of the fund assets. China, the United Kingdom, the Netherlands, and Japan round out the top five.

Unlike many CEFs, the BlackRock fund uses no leverage to goose returns or generate higher yield. Instead, the fund’s management team overlays the portfolio with a covered-call-option strategy. Over 24% of the fund’s investments are overwritten with call options.

The BlackRock fund’s investments combined with the cover-call overlay enable it to pay a $2.30-per-share annual distribution. The distribution is paid in monthly installments of $0.192 per share.

Distribution growth is part of the BlackRock fund’s history. The fund hit the public equity markets in August 2019. The fund has raised the distribution three times over the past three years. It even paid a special distribution in December 2020.

BlackRock’s distribution offers a starting annual yield of 14.8% today. When the fund came public at $20 per share in 2019, the shares were priced to yield 6.0% (based on the $1.20-per-share annual distribution at the time). The share price soared to $45 by mid-2021. But investor sentiment has changed dramatically over the past 18 months and the BlackRock fund trades near $15.50 today.

The technology sell-off presents an opportunity for us. We’re also able to buy the yield at a historically high discount, which improves our odds of realizing capital gains in the future.

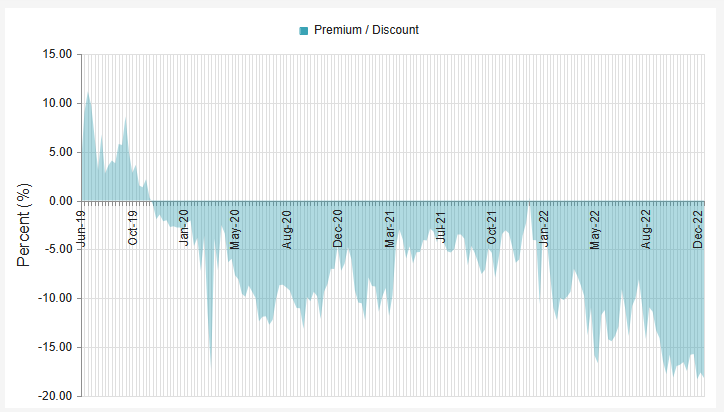

The BlackRock fund shares began life trading at a 10% premium to net-asset value (NAV). Today, they trade at nearly a 20% discount to NAV. The discount is at the extreme.

I’ll concede that the BlackRock Science & Technology Trust II is riskier than most of our other CEF recommendations. Technology is a volatile sector. The risk of a distribution cut runs higher. Indeed, the fund has had to rely on return of capital (ROC) to maintain the distribution this year. (It had not in previous years.)

That said, it is not unusual for a CEF to use ROC to maintain the distribution during volatile times. The ROC serves as a bridge to maintain continuity until the volatility subsides. In short, I think the potential reward justifies accepting the risk.