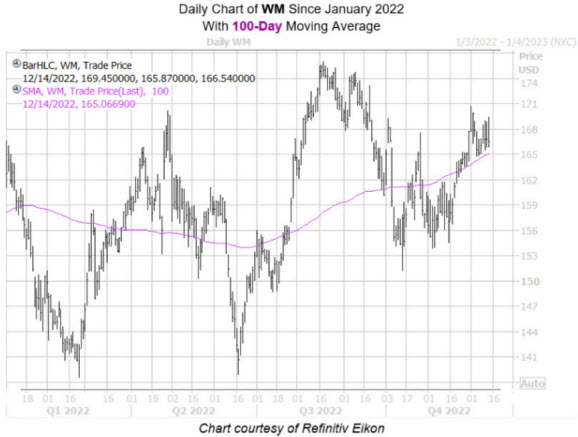

In the last quarter of 2022, Waste Management (WM) stock broke a technical downtrend and retested that level before advancing, observes Emma Duncan, managing editor for Bernie Schaeffer's advisory service, Schaeffer Investment Report.

WM is now back above its 100-day moving average, just off all-time levels, and has been a steady uptrend over essentially any timeframe you select.

For example, the shares are above their year-to-date breakeven while the SPDR S&P 500 ETF is off 16% in 2022, while their year-over-year breakeven remains positive compared to the SPY’s 13% 12-month haircut. Going back even further, WM’s three-year tally checks in at 54%, compared to the SPY’s 32% gain.

Despite this outperformance, put traders won’t give up. At the International Securities Exchange, Cboe Options Exchange, and NASDAQ OMX PHLX, the equity's 10-day put/call volume ratio of 1.50 sits higher than 71% of readings from the past year.

Echoing this, WM’s Schaeffer's put/call open interest ratio (SOIR) of 1.09 ranks higher than 67% of annual readings, meaning short-term traders remain quite put-biased. Digging deeper, five of the top open interest positions are puts.

WM is approaching its 12-month consensus price target of $174, and could see revisions or upgrades higher, especially considering seven of the 11 brokerages maintain tepid “hold” stances. And among short sellers, bearish bets have increased by 32% in the last four months, all while WM has rallied, hinting at the technical strength of the stock.

Even further supporting our case, several brokerages moved in with fresh bull notes. Raymond James approached with an “outperform” rating, Jefferies upgraded to a “buy” from “hold,” and both Citigroup and Citibank set “buy” recommendations, with the latter citing WM as an underappreciated natural gas opportunity.

In other words: jump on board the Waste Management train, as there remains ample buying opportunity for bulls in the weeks ahead. The stock is a top pick for 2023.