Just as the bears unanimously settle on impending market doom, a vicious rally is born, states Lucas Downey of Mapsignals.com.

Excessive pessimism breeds opportunity. Our data signals extreme appetite for stocks in 2023. Keeping a positive outlook on stocks in 2023 hasn’t been popular. The easier themes to harp on were decades-high inflation and rising interest rates. Conventional wisdom said to buy into the negativity. But here’s the deal...markets rarely follow the crowd. If your focus is solely on the here and now, you’re likely to miss the ultimate destination.

Keeping a calm head and looking forward is a better strategy. Data helps keep you on track. It has a way of muting the noise. Yesterday triggered some of the largest relative buying in stocks we’ve seen in years. We’re witnessing a wicked rally.

Extreme Appetite for Stocks in 2023

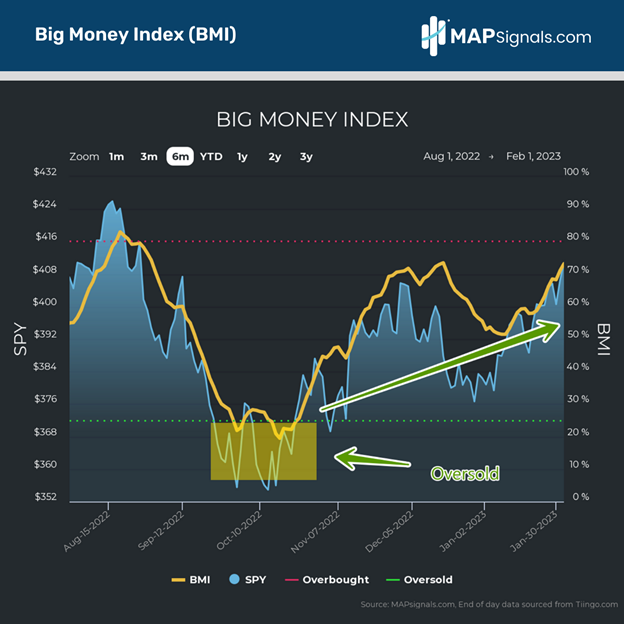

Understanding the trend of volumes in stocks will give you an edge. The best way to spot the trend of inflows is with the Big Money Index (BMI). Since late October, investor appetite has been steadily increasing. A rising BMI indicates demand for stocks is gaining. This morning’s reading is 73%, marching ever closer to the 80% overbought threshold:

That yellow line leads the market. From the depths in October, buyers have been increasing. I’ve shaded in yellow an oversold reading. It’s important to revisit market extremes. It set up a powerful buy opportunity. Buying during peak fear can be profitable for the patient. Congrats longs!

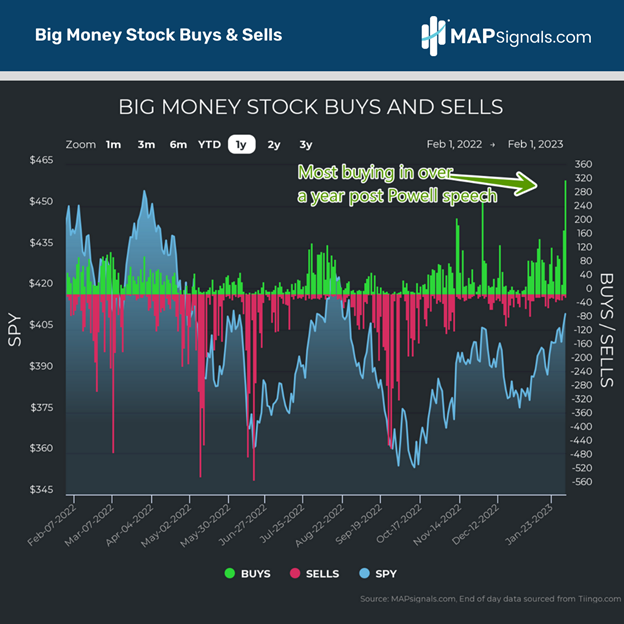

Today’s action however is the opposite side of the spectrum. There’s an extreme appetite for stocks in 2023. So, how does a market become overbought? There needs to be off-the-charts demand. Which there is. Below are the daily buys and sells of stocks. Post Powell’s speech yesterday, there were 330 stocks that logged unusual buy signals. Those are heavy-duty inflows:

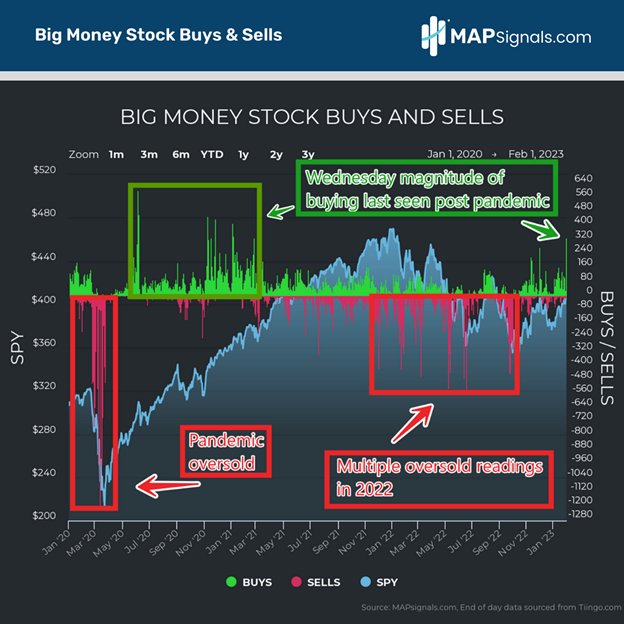

To see similar sized buying we’d have to go back to the post-pandemic rally of 2020. Back then, the fear was that the world could be over due to a pandemic. Investors fled stocks in droves, which ultimately preceded a rally for the ages. Below you notice how deep the selling was in early 2020. That extreme pessimism gave way to a new bull market. Today’s vault in buying is similar as the crowd shunned stocks for practically all of 2022:

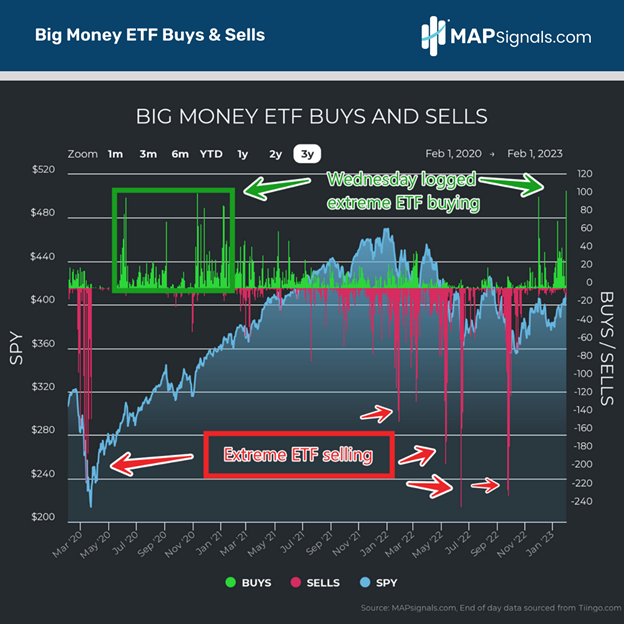

The same exuberance for equities can be seen via ETFs. Afterall, those are baskets of stocks, popular with retail investors. Wednesday logged the most buys ever in our data. Keep in mind new ETFs tend to launch each week, so fund counts are increasing over time. Nevertheless, only at extreme points do we see this level of demand:

The caterpillar was certain the future was over. She was wrong. Investors too can sour on stocks at the moment prosperity comes knocking. Data has a wonderful way of keeping your emotions in check. MAPsignals’ unique approach can offer a narrative that’s often contra to the news. If you’re not using data in your process, you’re missing out.

Let’s wrap up.

Here’s the bottom line: There’s an extreme appetite for stocks in 2023. In fact, Wednesday logged the most buys we’ve seen in years in stocks and ETFs. The current rate of buying will not last forever. There’s a good chance we’ll reach overbought in the BMI in the coming days/weeks, so caution is warranted.

My hunch is that we may stay overbought longer than August’s reading simply due to the fact that we’re coming off 5 oversold readings in 2022. This is a welcome change!

To learn more about Lucas Downey, visit Mapsignals.com.