Dividend aristocrats are any stocks that have raised their dividends every year for the past 25 years, notes Jimmy Mengel, editor of The Profit Sector.

To qualify, the company must also be a member of the S&P 500, have a market cap of at least $3 billion, and average at least $5 million in daily share trading value for the preceding three months.

Companies are added every January based on the above requirements; on brand new name for the Aristocrat list this year is J.M. Smucker (SJM). All told, the company operates in three segments: consumer foods, pet foods, and coffee.

The kid in all of us knows J.M. Smucker from their PB and J holdings: Jif peanut butter and Smucker’s jellies and jams. The company also boasts such coffee brands as Folgers, Dunkin', and Café Bustelo. The pet food segment holds Kibbles ‘n Bits, Meow Mix and Milk-Bone.

All of these are iconic brands that have been around for decades and have landed J.M. Smucker onto the Fortune 500, with an estimated 2022 market value of $14.6 billion. The company was able to withstand inflationary pressures by raising the prices of its brands, most of which are staples in everyone’s pantry and some of the last products consumers decide not to buy.

That is to say, when times are tight, we’re still buying peanut butter, coffee, and dog food. For example, coffee sales rose 10%, and pet food sales rose 14%.

Overall, the company posted $2.2 billion in sales last quarter, up 8% from the year prior. Over the last three years, J.M. Smucker posted an annualized total return (including dividends) of 15% and an 8.4% return over the past year. The S&P dropped 7.4% during that time frame.

The resilience during the inflationary pandemic environment allowed SJM to increase guidance for this year, with a prediction for net sales to increase 5.5 – 6.5%, which is a full percentage point higher than initial estimates.

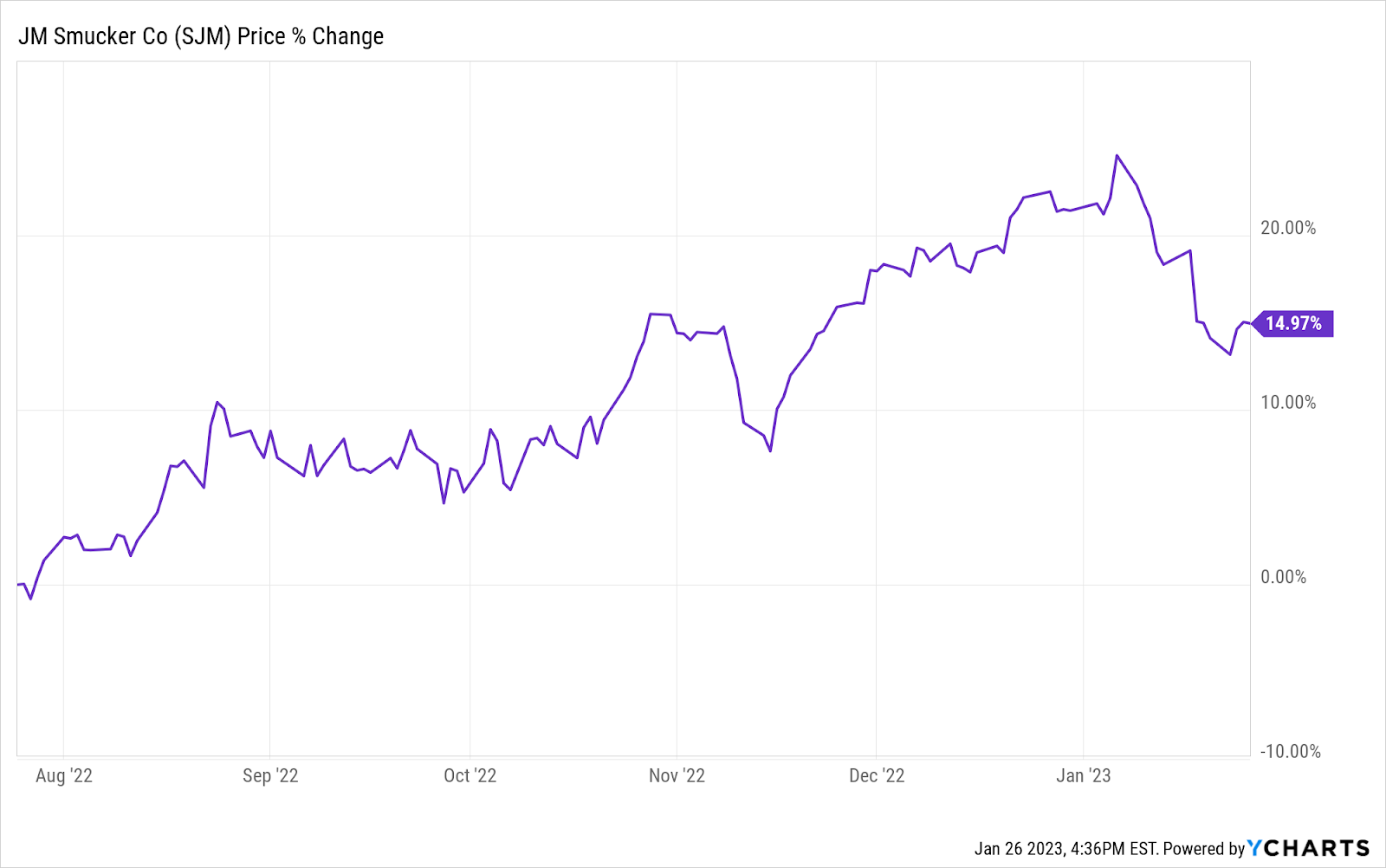

SJM has been even more impressive over the past six months:

The company landed on 2023’s dividend aristocrat list because they just approved a $1.02 per share dividend on common shares. SJM now yields 2.76%. J.M Smuckers is an excellent buy-and-hold stock that will slowly build over the long term. Just make sure to reinvest those dividends.