You’d think that in a growing economy with low unemployment and a Federal Reserve nearing the end of its rate-hike cycle, just about anything would be more interesting than “boring” municipal bonds, suggests Michael Foster, editor of CEF Insider.

You’d be mostly right, except for the RiverNorth Managed-Duration Municipal Income Fund (RMM). The closed-end fund's 6.9% discount to NAV indicates that investors are still not impressed with the fund’s 7% tax-free yield, which is the taxable equivalent of 11.6% to taxpayers in the highest bracket.

But the mainstream crowd is wrong: RiverNorth Managed-Duration, and its clever muni-investing strategy, are perfect for the environment we’re in.

RMM’s Risk Management: Its Secret Sauce

Source: RiverNorth Management

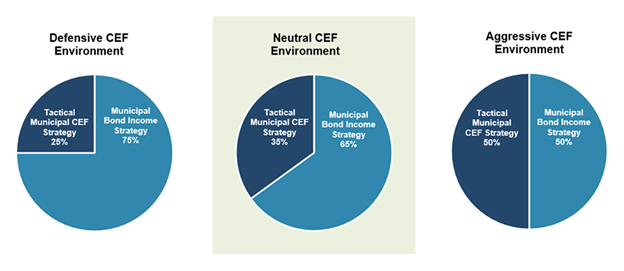

If you recall, RMM practices a “fund of funds” strategy, which is something I don’t normally recommend because the extra management costs of owning other funds can hurt our returns. But we’re making an exception for RMM because of the way it uses other municipal-bond CEFs. In fact, at some points it’s barely a fund of funds at all!

For example, when the market is volatile, RMM pivots to holding a diversified basket of municipal bonds directly—with a particular focus on longer-term bonds with bigger yields—and away from municipal-bond CEFs. That cuts the fund’s volatility, since individual “munis” are less volatile than muni-bond funds.

Then, when markets improve, RMM pivots away from that strategy and toward municipal-bond CEFs. The idea is that owning other muni CEFs lets RMM profit from the inefficiencies of the CEF market — namely by buying funds when they are overly discounted and selling when they’re overbought.

That strategy has helped RMM outperform the benchmark iShares National Muni Bond ETF (MUB) since the depths of the COVID-19 crash in March 2020, which ushered in one of the most unpredictable markets of our lifetimes.

The fund’s discount, and those on the muni-bond CEFs it holds, are likely to keep this outperformance going, at least until RMM trades at a premium. Action to Take: Buy the RiverNorth Managed-Duration Municipal Income Fund (RMM) up to $23.00.